Gold Price Forecast: Gold To Rise On Fed Dollar Debasement

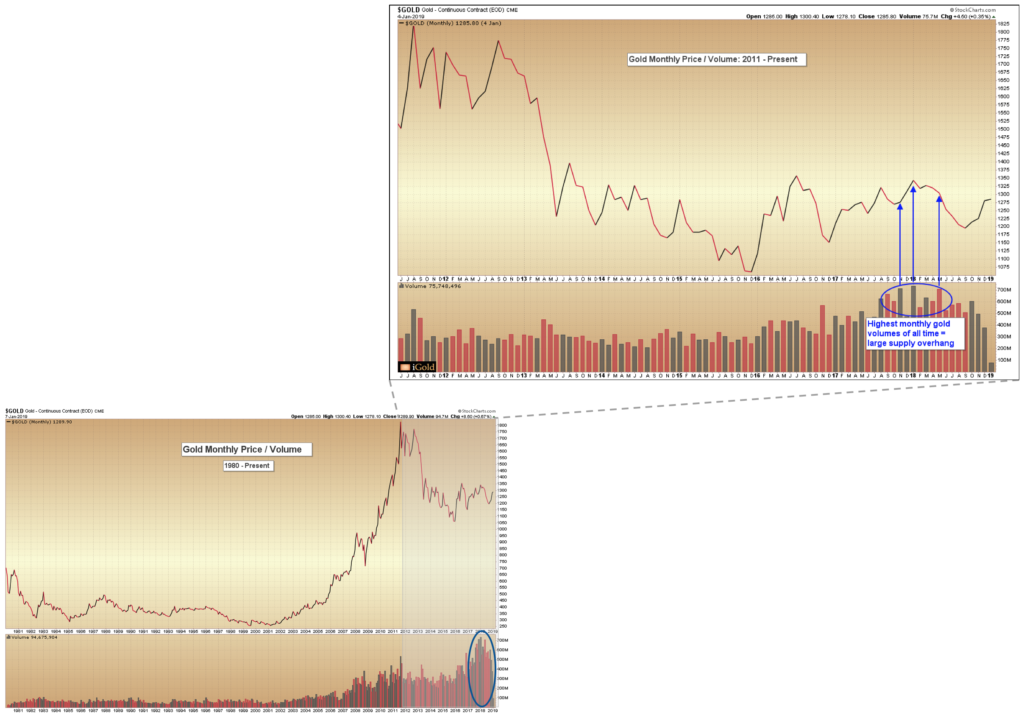

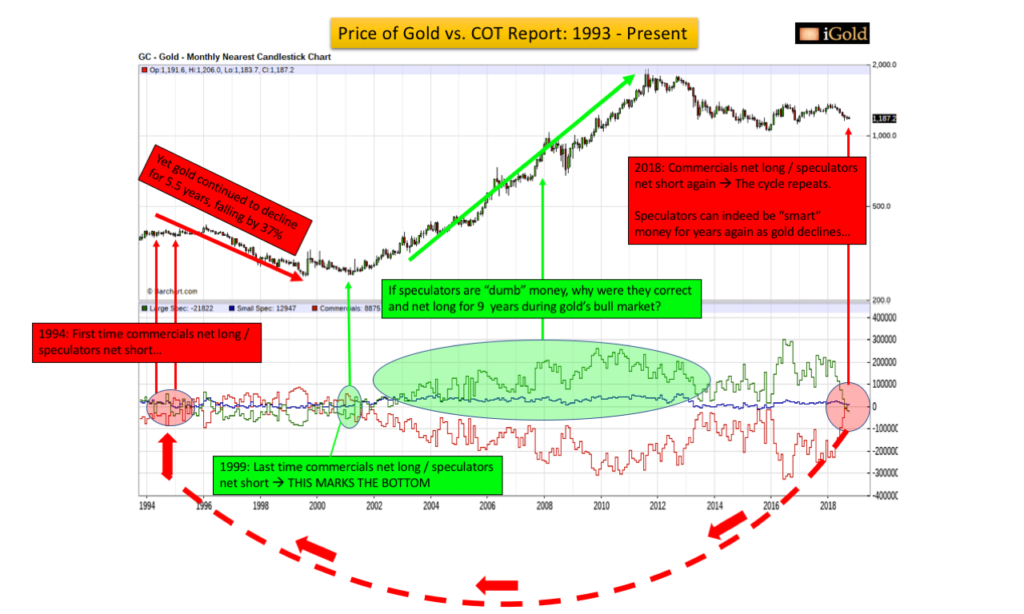

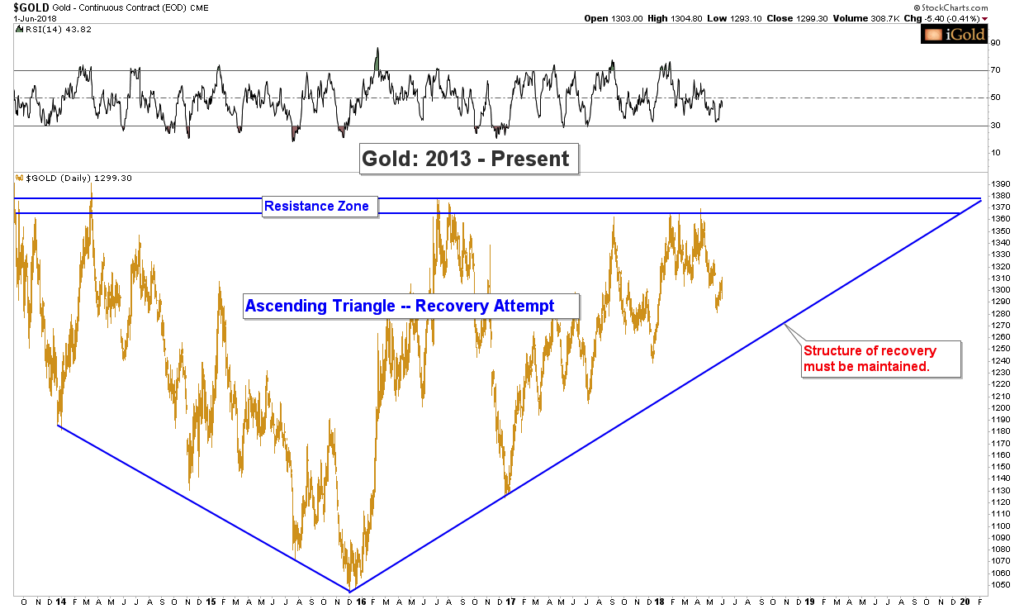

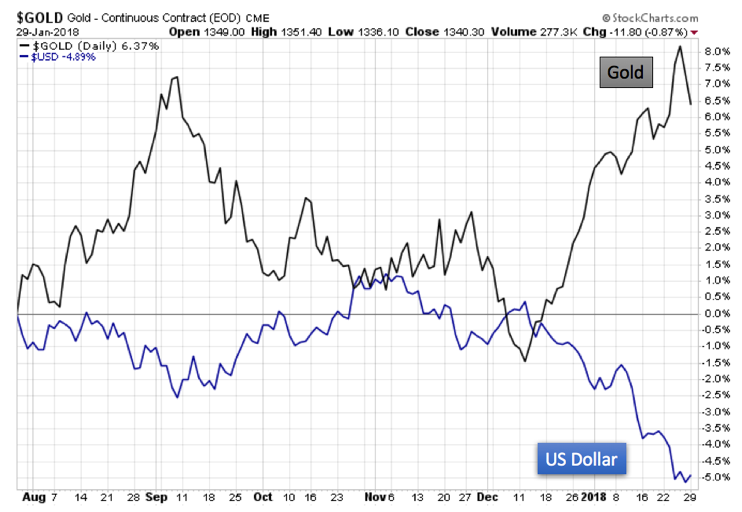

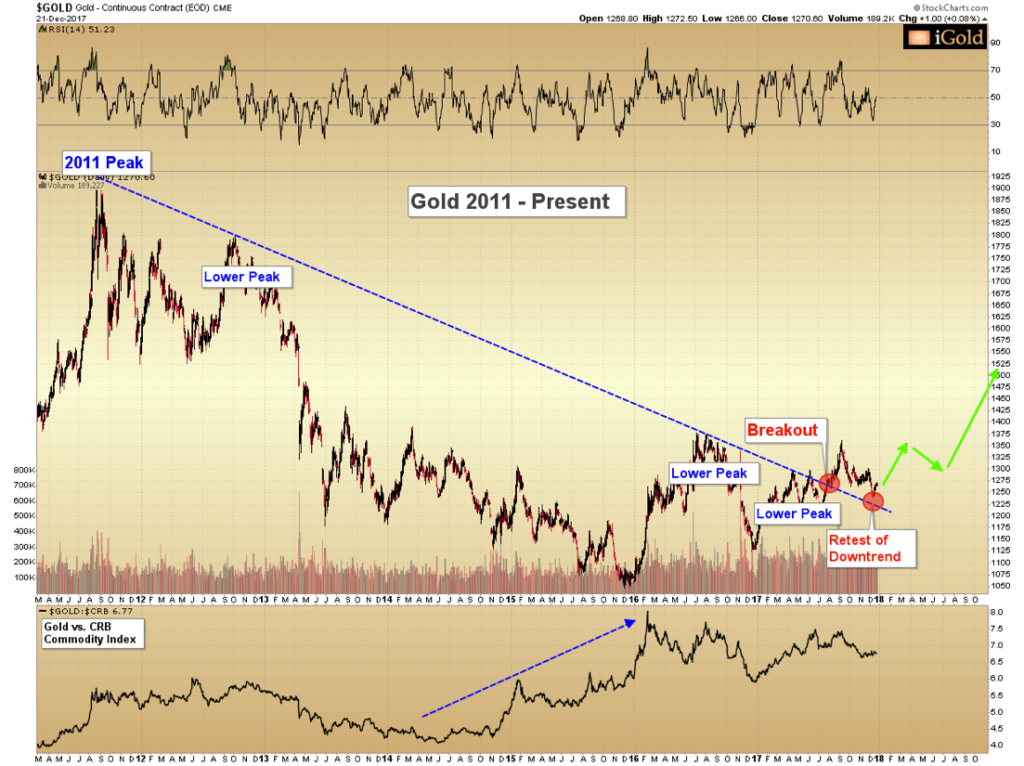

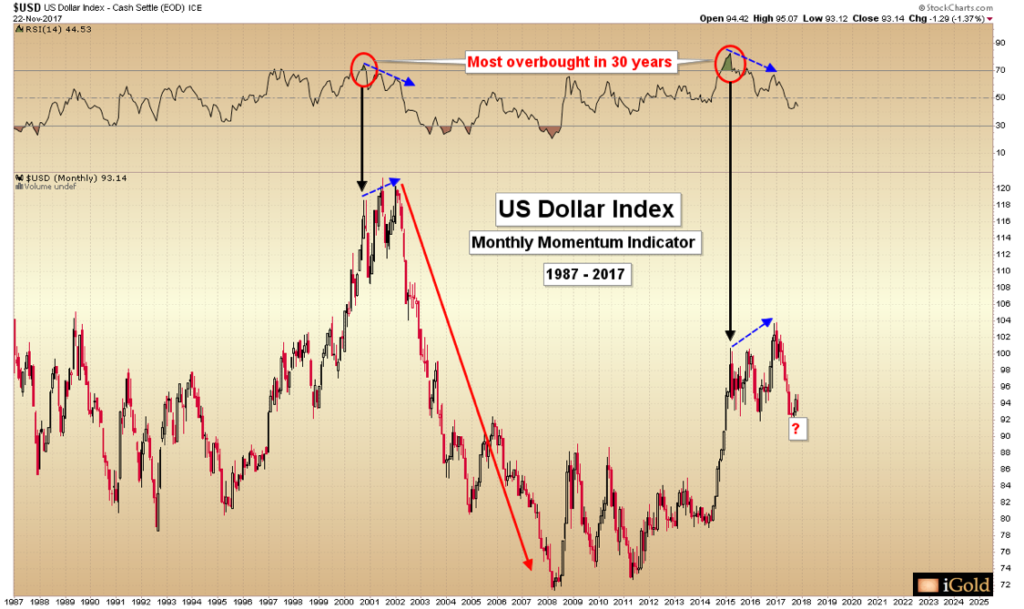

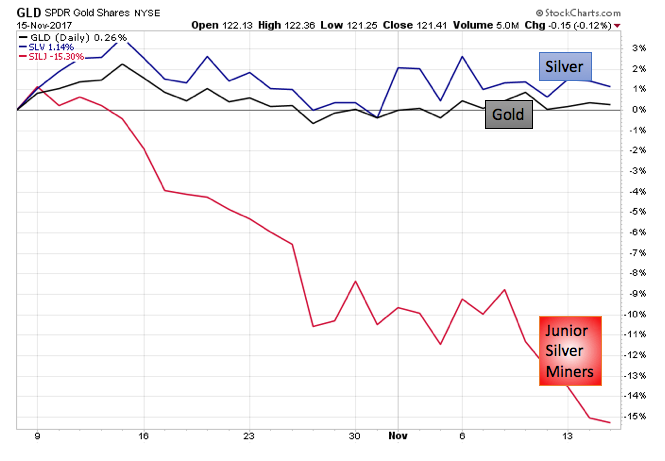

We are starting to get a stronger sense of what will be causing 2020’s advance in gold and silver: weakness in the US dollar and a concurrent inflationary spike in the entire commodity sector.

Gold and silver sometimes act on their own, independent of what is happening to the broader commodity world. However, at other points gold and silver will get pulled together with the rest of the resource sector – this is what is about to occur in the precious metals world.

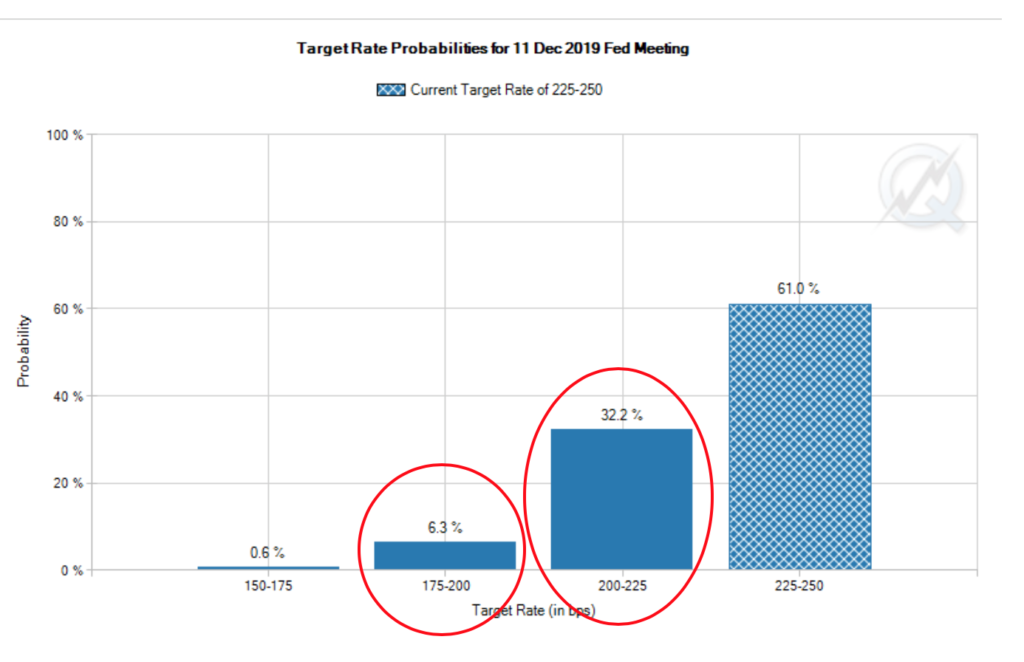

The market does not need the Fed to intervene in the repo market, nor in any market for that matter. If lending in the repo market has gotten tight, there is a reason for that: lenders are cautious due to dubious fundamentals within the wider economy. The idea that the Fed should act to supersede the independent decision-making of individual institutions involved in the repo market is one that leads to a slippery slope of moral dilemma as problems grow larger and larger.

Not only did the Fed outline a new $425 billion “liquidity” program this week, it also promised to print more money by buying short-term US Treasury bonds if financing pressures required such. Fed Chairman Jerome Powell stated explicitly:

Click here to continue reading for FREE on our partner site, Gold Eagle…