Announcing the world’s leading private placement investment opportunities:

by

Elite Private Placements is a service for sophisticated investors looking for the opportunity to achieve life-altering gains in the precious metal and natural resource sectors.

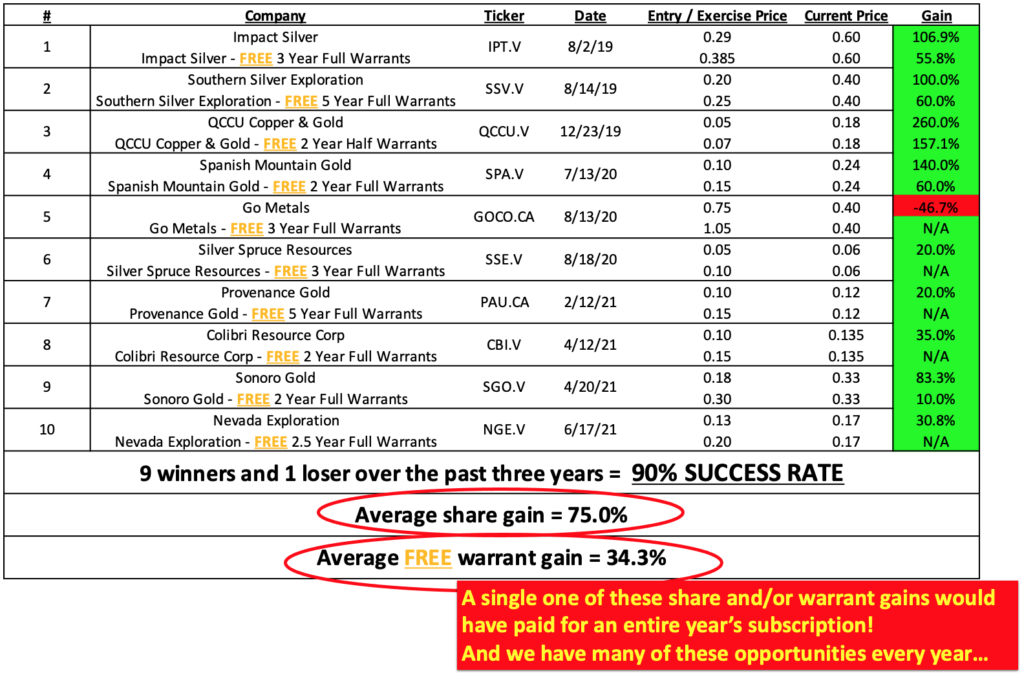

Over the past three years, our elite private placements have included the following winners…

Spanish Mountain Gold Ltd., which skyrocketed 620% in less than 2 months after our investment:

Impact Silver Corp., which gained 290% within one year of our investment:

What is a Private Placement?

A private placement is an investment vehicle in which investors purchase shares directly from the issuing company, and not on the open market. Private placements allow companies to raise new capital to advance their mines and deposits. In exchange for helping the companies to finance their operations, the issuing companies reward investors in several significant ways (see below):

What are the Benefits to Private Placement Investing?

There are three primary benefits to investing via private placement, which are not available when buying on the open market:

- In private placements, shares are often offered at slightly below the open market price; thus, investors may be in a profitable position immediately upon the close of the deal, instead of having to wait for share price appreciation.

- Private placements often include a free warrant with each share purchased. A warrant gives an investor the right, but not the obligation, to buy additional shares in the future at a set price and within a set time. If the company rises in value, exercising these warrants can allow an investor to double his position size. If the company declines in value, then the warrants are simply not exercised and no additional loss is incurred. Effectively, warrants allow the investor free additional upside potential with no additional downside risk, aside from the required 4-month holding period which is standard in all private placements.

- Private placements allow investors the opportunity to accumulate positions in small companies without the risk of disrupting the share price by making large open-market purchases.

What is the Secret to Our Success?

It is the power of stage analysis.

We are the only firm in the natural resource sector which uses strict technical analysis to separate high-quality candidates — those prepared to offer life-altering returns — from potential losers.

These technical screens are so proprietary and confidential — we will not release them to anyone outside our firm, and we require strict confidentiality agreements from anyone who sees the source code.

However, the good news is that you don’t need to see the actual source code in order to benefit from our proven selection process.

Elite Private Placements gets you exclusive access to all of the private placement investments that we are making as a firm.

What is Stage Analysis?

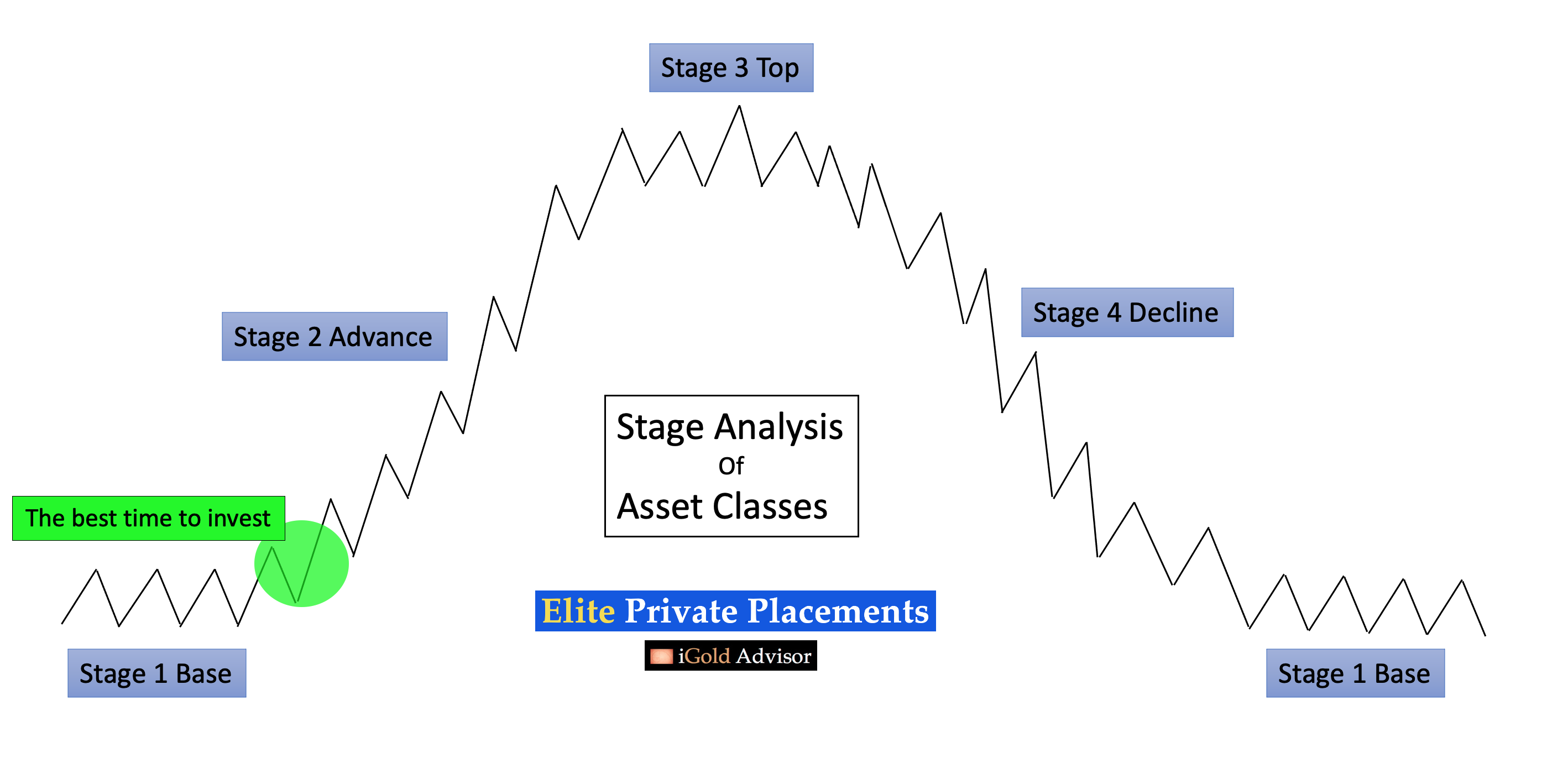

Stage analysis argues that all asset classes move through a lifecycle of four distinct stages:

- A basing (consolidation) stage

- An advancing (bull market) stage

- A topping (distribution) stage

- A declining (bear market) stage

Stage analysis may be visualized using the following diagram:

And although this form of analysis may seem rudimentary, it is actually extremely powerful when properly applied.

So powerful, in fact, that this technical screening is the #1 criteria by which we evaluate all of our natural resource and commodity investments.

Nonetheless, because it is simultaneously so powerful yet so simple, we often see even sophisticated money managers ignore this most basic rule:

Only buy stocks which which are at the end of stage 1 bases.

By following this one powerful rule, we can focus on only those investments with extremely favorable risk-to-reward profiles.

But don’t take our word for it. Consider the proven examples above, or read some of the words of our existing subscribers who have already made incredible returns by investing in late stage 1 companies alongside us:

Testimonials

“I ended up pulling the trigger a bit earlier then you but I’m also very happy with the overall investment into IPT. I got into this business in late 2017 and since then not much had gone right until this investment. Made me close to a 100% return in about 11 months when you combine the shares and warrants together… thank you.”

-Kyle J., Toronto, Canada.

**********

“Thanks Christopher… you’ve picked another big winner. Thanks for making this possible!”

-Lyn H., California, USA.

**********

“I want others to gain confidence and succeed in this market along with us. It’s been many years since I was a big trader and getting these wins is really nice!”

-Jason M., Florida, USA

**********

Why Commodities? Why Now?

Why is now the ideal time to invest in the commodity and natural resource sectors?

Because the entire commodity sector is just breaking out of a huge stage 1 base bottom pattern!

Below we show the CRB commodity index — an average of 19 natural resources including gold, silver, platinum, palladium, copper, oil, and natural gas (amongst others) — from 1999 through present:

- Note how the CRB peaked in the year 2008 at 470 on the index, leading up to the Global Financial Crisis…

- The sector topped in 2008 and subsequently declined until the Coronavirus lows of 2020… almost 12 years later.

- Remember that it is IMPOSSIBLE for the sum of the world’s commodities to go to zero. Yet between 2008 – 2020, the sector declined by approximately 80%!

- When a sector that cannot go to zero has fallen by nearly 80%, WE SHOULD BE INTERESTED in accumulating that asset class for the eventual reversion higher. Risk is inherently limited when so much of the past decline has already occurred.

- In our case, the entire sum of the world’s commodity sector is now just finishing a 12-year decline and breaking out of a stage 1 base. Remember back to the stage analysis diagram above: following a stage 1 base, a stage 2 advance is expected to begin. This will feature many incredible investment opportunities for natural resource investors over the coming years.

In sum: an asset class which the world will continue to need into perpetuity has already fallen by 80%… it cannot go to zero… and it is now breaking out of a healthy stage 1 base —> Stage 2 Advance… here we come! (Even better with free warrants for nearly double the upside of a normal investment opportunity.)

Adding the Power of Warrants

Carefully choosing late stage 1 base candidates becomes even more powerful when we add in the power of warrants to the process.

What are warrants?

Warrants are similar to options: they are contracts that give the owner the right, but not the obligation, to buy more shares of a stock in the future, at a set price.

Now, warrants are extremely powerful. They offer tremendous upside potential for a stock. However, most investors have to pay a hefty premium to buy their warrants. And even worse, oftentimes after paying that premium, those warrants end up expiring worthless.

This is where private placements have a distinct advantage: in private placements we are given our warrants for free. Yes, absolutely free.

In contrast, those who buy stock in the open market are not given warrants at all. Their upside is limited simply to the number of shares that they buy with actual cash.

By purchasing stock via private placements, we as investors can nearly double our upside potential, with no additional downside risk, aside from the typical four-month hold period for the shares.

Consider this hypothetical example:

- John buys $10,000 worth of ABC Corp. in the open market at $0.10 cents per share. Over the next two years, the share price rises to $0.30. John has achieved a 3X return on his initial investment, and ends with $30,000. Not bad.

- Mark buys $10,000 in the same ABC Corp. However, he does so via private placement instead of the open market. Over the next two years, the share price rises to the same $0.30. Mark achieves the same 3X return on his initial investment.

- However, Mark also received a free full warrant good for three years, exerciseable at $0.15 cents since he participated via private placement. Mark’s return is calculated as follows:

Mark was able to cash in his original shares at a 3X return ($30,000), the same as John –>

Mark then takes half of that capital ($15,000) to exercise his full warrants at $0.15 –>

He then cashes in the warrants again at $0.30 for another 2X return ($30,000) –>

- The net sum is that Mark ends up with $45,000 or a 4.5X return on his original investment. This compares with only the 3X that John made. Mark makes 50% more than John — for the exact same investment — simply by participating via private placement.

As we can see, the power of receiving free warrants is tremendous. I know of no better way to receive free additional upside potential, with next to no additional risk, other than by free warrants via private placement. This is indeed a game changer, and it is why our service is focused exclusively on the world’s elite private placement opportunities.

**********

Success Even in Stagnant Markets

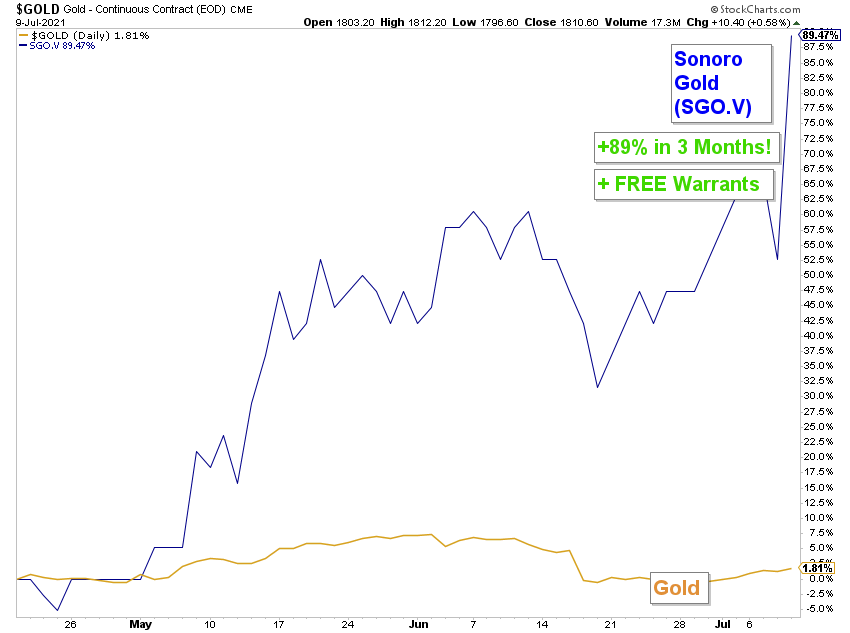

Our proprietary technical analysis + free warrant combination is so powerful, it can even produce winners in stagnant markets.

Consider the following investment that we negotiated on April 21, 2021 with Sonoro Gold, a gold development company based out of Canada. Note that even as gold has been stagnant over these last three months, our shares of Sonoro Gold have risen by over 89%!

This is the power of properly selecting stage 1 base companies to invest in:

A Partner in Negotiation – Working for You!

It’s not only that we have the ability to properly screen for high-reward stage 1 base candidates which feature favorable risk-to-reward ratios. What makes our service truly unique in the commodity world is that we take no fees nor kickbacks from any of the companies that we invest in.

You see, in this industry, most analysts who come across as independent are, in fact, actually being PAID by the mining companies to sell shares to you. How can an analyst claim to be publishing honest research when they are receiving kickbacks from the very companies they promote to you?!

The answer is: they cannot. Most analysts have sold out – and YOU pay the price.

At iGold Advisor’s Elite Private Placements, we have adopted a completely different business model: we take no fees, no kickbacks, and no compensation from any of the companies that we bring to the negotiation table.

Instead, our interests are aligned with your interests in this service. We invest together.

iGold’s founder, Christopher Aaron, personally invests alongside you in each private placement that we feature.

With the combined investment capital of our entire group, we are able to negotiate better investment terms with the mining companies on your behalf!

With the combined investment capital of our entire group, we are able to negotiate better investment terms with the mining companies on your behalf!

Consider an investment that we made one year ago, in which a gold mining company offered us half of a warrant for each share purchased, as part of the private placement deal.

With dozens of investors coming together and raising nearly $1 Million to advance the company’s gold mine, we were unsatisfied with only half a warrant.

And so we negotiated with the company on our investors’ behalves, over multiple meetings spanning several weeks.

The end result?

The company agreed to issue us full warrants as opposed to the half warrants originally offered.

This negotiation doubled our upside potential via the warrants as compared to if we had settled for mere half warrants.

Remember, our business model is different from most:

OUR GUARANTEE

OUR GUARANTEE

We take no fees nor kickbacks from any of the companies we invest in. Instead, we negotiate on your behalf in securing the most favorable terms possible so that we all have the opportunity to profit together.

When you join iGold’s Elite Private Placements, you are not only subscribing to a research service, you are gaining a hands-on partner in the investment business.

Additional Testimonials

Consider our track record in private placements over the past three years — a 90% success rate as of July, 2021 — join today!

Join Today!

Only $2,995/Year

Frequently Asked Questions (FAQ)

What is the minimum investment amount for each private placement opportunity?

The minimum is typically $10,000 in Canadian dollars per opening (approx. $8,000 US / 6,800 EUR / 5,900 GBP / 10,800 AUD).

Which commodities do the private placements focus on?

The majority of our private placement investments will focus on precious metals (gold, silver, platinum, palladium), industrial metals (copper, zinc, aluminum, lead), battery metals (nickel, cobalt, lithium), and the energy sector (uranium, oil, natural gas). We may also have occasional placement opportunities in additional natural resource sectors.

I am from _____ (country). Can I participate in this service?

In working with thousands of individuals over the last decade from around the world, we have never encountered a single investor who could not participate in private placements due to their citizenship or country of birth.

On rare occasions, a single private placement will be closed to investors of a specific country. However, this is the rare exception, rather than the rule. Note that we will have multiple private placement openings per year, and so even if a (rare) single one is closed to a specific country, there will be others available within a short period following.

How many private placements do you expect to have available each year?

The exact amount will depend on a host of factors, including market conditions, company demand for new capital, and our ability to negotiate agreeable investment terms with issuers. Thus, we cannot give the precise number of openings that will be available each year.

Generally, however, we expect to have four (4) to six (6) private placement openings available each year, each of which we expect will have the potential for massive revaluation higher.

Am I obligated to invest in each private placement you feature?

No. You are free to invest alongside us in as many or as few placements as you feel comfortable. There is no obligation.

Remember that we are stronger together as a group. By bringing many investors together, we can successfully negotiate for better terms for shares + free warrants with the mining companies.

Generally, we find that investors achieve the best returns by investing in at least five (5) placements within an 18-month period, taking profits at select intervals, exercising their warrants once profitable (i.e. “in-the-money”) and then re-investing those profits into future investments, thus multiplying wealth over time.

How do I receive my shares + free warrants?

The process is quite simple. Once you complete your first placement, you will find that the entire process generally takes no more than 20-minutes. The easy steps are as follows:

- Fill out the subscription forms and return back to us.

- Wire funds in Canadian dollars from your bank directly to the mining company’s bank.

- Your share certificates + free warrants will then be sent to you within 2-3 weeks of the closing date, either by:

- Courier (FedEx, DHL) to your home address (which you can then deposit with a brokerage at a later date), or

- Directly to your brokerage (contact your broker to ask for their delivery instructions).

- That’s it! You have successfully invested in a private placement — now wait for the company to utilize the funds to advance its mining operations –> and expectantly realize a profit on your shares + free warrants.

Will _____ (brokerage) accept my private placement shares + warrants for deposit?

The best way to find out if your brokerage accepts physical certificates + warrants received via private placement is to contact their customer service department directly and ask.

If your brokerage cannot, we can introduce you to one which can in most cases.

Do I need to be accredited in order to invest via private placement?

The regulations in Canada, in which the majority of the mining companies in the world are domiciled, state that investors must be accredited by either having (a) annual income of $200,000+ per year before taxes for each of the previous two years (or $300,000+ combined with spouse), or (b) individual net worth or combined net worth with spouse of $1,000,000 or greater.

Note that the accredited investor status is typically a single check-box on the subscription forms. We have never witnessed these figures being verified during any step of the process. These criteria exist primarily to protect investors from taking excessive risk in relation to their overall financial positions. We encourage all investors to carefully review their financial positions to see if they possess the proper risk tolerance for private placements and would qualify.

Do you issue sell signals for each equity that you invest in?

We do not issue individual sell signals for each company stock. However, we do issue general sell guidance for all of our investments.

The reason we do not issue exact sell signals for each equity is because with hundreds of investors each taking positions, if we suggested that all investors sell at a single instant we might crash the value of the stock. This type of disorderly exit from a position is neither in the best interests of ourselves as investors, nor of the mining company itself.

Instead, we issue general sell guidance for all of our investments.

We suggest that investors exit their positions using the following strategy:

- Take one’s initial capital investment off the table (i.e. realize profit) either (a) once the investment has risen by 2X to 3X of the original amount, or (b) when the capital is needed for a new investment.

- Hold the free warrants until a few months before the expiration date (typically 2 – 5 years). If the share price is above the exercise price by that date (i.e. in-the-money), investors will realize an additional profit via their warrants. We suggest that investors then take their initial warrant capital off the table (realize profit) either (a) once the exercised warrants have risen by 2X to 3X of the exercised amount, or (b) when the capital is needed for a new investment.

- The remaining shares + exercised warrants may be retained until higher prices, thus representing risk-free investment potential. Essentially by that point, one is “playing with house money”, which is a very powerful advantage to have in the markets.

- One may then re-invest one’s initial capital into the next available placement, thereby multiplying wealth over time.

Do you offer discounts?

This service is for sophisticated investors who are looking for opportunities to achieve life-altering gains in the natural resource sector over the coming year.

If the subscription price is beyond your reach, then this is not the right service for you.

If you have participated in even a single one of our successful private placements offered over the last three years, you have made a multiple of the annual subscription price already.

Remember that your subscription not only gets you access to all of our exclusive private placements, but it also entitles you to our skilled negotiation with mining companies on your behalf for better placement terms.

Recall that cheaper services may be taking kickbacks from companies, resulting in a conflict of interest — this is NOT our business model, and so we charge a fair amount for the service up front.

We believe your subscription will pay for itself with one successful investment — and we will have many such opportunities over the year ahead.

Any other questions? Contact us.

Legal disclaimer: iGold Advisor is a comprehensive research and analysis firm. Elite Private Placements is an investment research service for investors seeking to participate in private placement opportunities in the natural resource and commodity sectors. The materials presented herein contains the exact investments and trades that we are making as a firm. iGold Advisor and all contributing authors of Elite Private Placements own the portfolio of equities disclosed herein as of the dates published.

Neither iGold Advisor nor any contributing author of Elite Private Placements are registered financial planners nor investment advisors. We are independent thinkers and investors with a passion for rigorous analysis. As each individual will have a unique risk tolerance and time horizon, this research inherently cannot serve as an official recommendation to buy or sell any financial instrument.

All investments involve the opportunity for gain and also a risk of loss. We expect that we will profit largely over the sum of our investments, but no guarantee can be made. Under no circumstances shall iGold Advisor nor any contributing author of Elite Private Placements be held liable for gains or losses that may result from your decision to act based on this research or analysis.