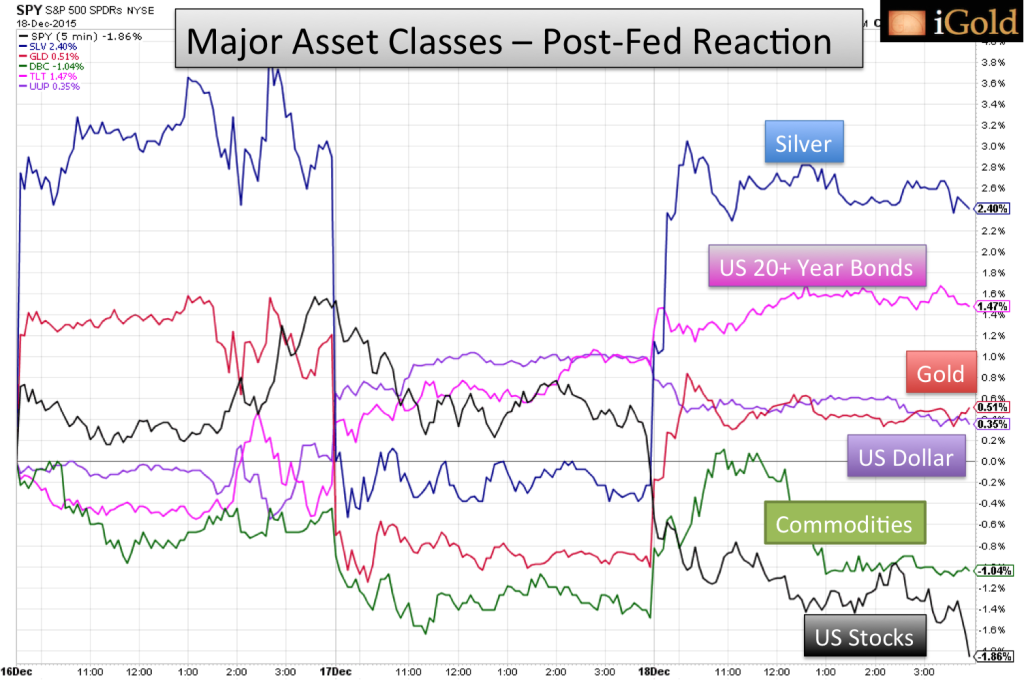

Gold has been weak over the last few days, falling back down to $1,225, as this article goes to press. The major contributor to gold’s fall has been strength in the U.S. dollar since last Wednesday, when the Federal Reserve released minutes from its most recent policy meeting, hinting at a stronger chance of a rate hike at its upcoming June session. Higher interest rates tend to strengthen the value of the dollar versus foreign currencies, as investors can achieve a higher rate of return by holding US-denominated debt.

Over the short run, a stronger dollar often corresponds to weaker gold prices, as traders see less need for the age-old metallic store of wealth when the fiat dollar is firming.

Indeed, when we look at the very short-term action in the U.S. Dollar Index versus gold, we can clearly see this inverse correlation. Note how the recent high for gold at $1,305 corresponded within one day to the low seen in the Dollar Index at 92.5. Since then, as the dollar has risen, gold has fallen:

It is tempting to want to extrapolate this phenomenon into longer time periods. For example, what if the dollar continues to rise? Will gold keep falling?

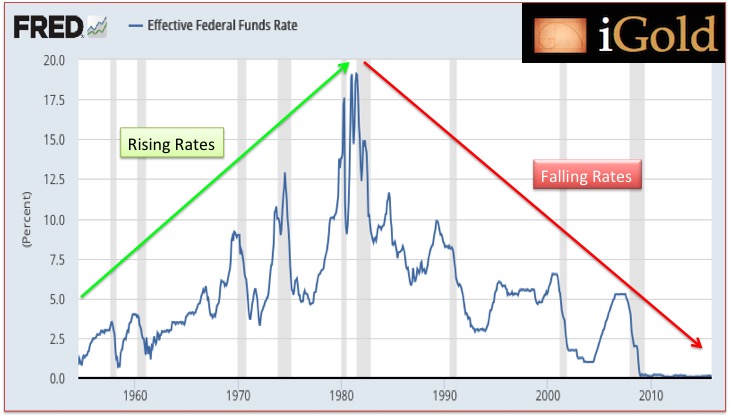

U.S. Dollar Index – Meaningless Over the Long Run

We want to caution readers that over the long run, the value of the US dollar versus other international currencies (which is what the U.S. Dollar Index measures) has little impact on the price of gold. We must remember that in today’s monetary system, for the first time in the history of human civilization, not a single currency has any direct tangible backing to it. Thus, measuring the U.S. dollar versus the Euro, the British pound, or the Australian dollar is a relative measure of one fiat currency versus another. Each currency is being debased – simply at different speeds.

Over the long run, the U.S. Dollar Index has little impact on the price of real assets such as gold, silver, land, or other commodities. We can see this when we back out our chart above to a generational time frame.

Below we show the U.S. Dollar Index and gold since 1980. We have picked the recent figure on the Dollar Index at 92, and then drawn highlights to show the corresponding gold price at other times throughout the last few decades when the index matched the same 92 level.

Note how over these decades, while the dollar index has essentially gone nowhere, oscillating above and below the 92 figure, gold has seen the following four prices: $450 in 1988, $300 in 1998, $450 in 2005, and $1,300 in 2016.

Note also that gold’s high of $1,900 in 2011 did not match the dollar’s low of 72 in 2008. Nor did the dollar’s high in 1985 match gold’s low in 1999.

The Dollar Index is meaningless for gold prices over the long run. Gold is moving independently of any relative fluctuations between fiat currencies.

In other words, gold’s rise must be a worldwide event.

Continue reading the full article for free on our partner site Gold Eagle…