Author: Christopher Aaron

*VIDEO* Lithium Market & Nevada Sunrise 2310 – Introduction

*VIDEO* 2023 09 28 iGold Precious Metals Intelligence+ 389

Gold Price Forecast: $1,885 the Key Test for 2024 – 2025

Following Wednesday’s Federal Reserve meeting, the gold market is at a make-or-break moment: if key support at $1,885 can hold over the coming weeks, gold should be set to break to new all-time highs later this year or early 2024. However, if this key support fails, gold will likely not be breaking out until 2025 in the best case scenario. In a worst case scenario, a failure at $1,885 would imply that a long-term top is already in place for the sector.

Following a long-term top, years or even decades of lower gold prices would manifest. It is thus imperative for investors to follow these significant trends that are now being tested.

Let us examine the key support areas to define these tests in the gold market.

Click HERE to continue reading for free on our partner site, Gold Eagle…

*VIDEO* 2023 09 21 iGold Precious Metals Intelligence+ 388

*VIDEO* 2023 09 14 iGold Flash Update

US Dollar Collapse!!

Test Fixed Player: *VIDEO* 2023 09 14 iGold Precious Metals Intelligence+ 387

*VIDEO* 2023 09 14 iGold Precious Metals Intelligence+ 387

*VIDEO* 2023 09 07 iGold Precious Metals Intelligence+ 386

Gold Price and Gold Miners Update

*VIDEO* 2023 08 31 iGold Precious Metals Intelligence+ 385

Silver Price Forecast — Breakout Triggers

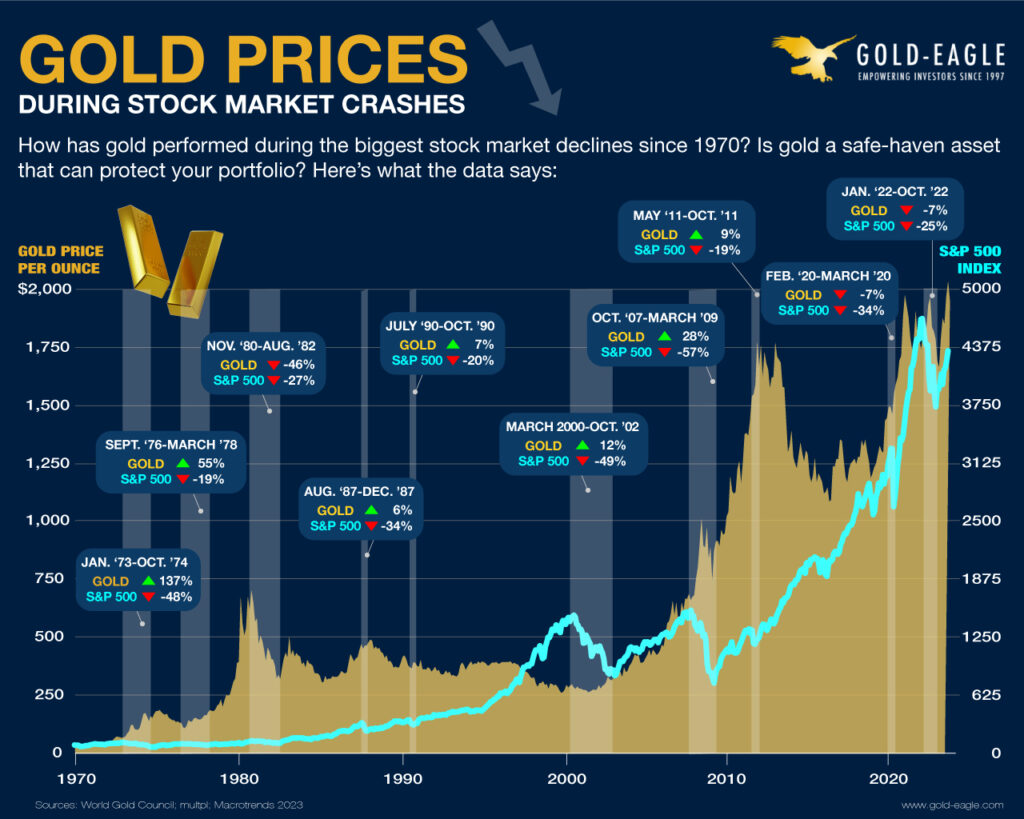

Gold Prices During Stock Market Crashes

How does gold perform during stock market crashes?

Gold has long been viewed as the “safe-haven asset” – one that can protect investors against the ravages of stock market crashes.

But does gold’s safe-haven reputation still hold up? Can gold actually protect your portfolio from a tumbling stock market? We turned to the data for an answer.

The above analysis shows the 10 biggest declines in the S&P 500 since 1970 and compares them with gold price movements during the same time. We used nominal data from Macrotrends and the World Gold Council.

Click here to continue reading the full article for FREE on our partner site, Gold Eagle…

*VIDEO* 2023 08 24 iGold Precious Metals Intelligence+ 384

Gold Price Forecast + Battle with US Stock Market

*VIDEO* 2023 08 17 iGold Precious Metals Intelligence+ 383

*VIDEO* 2023 08 10 iGold Precious Metals Intelligence+ 382

*VIDEO* Provenance Gold 2308 – Introduction

*VIDEO* 2023 08 03 iGold Precious Metals Intelligence+ 381

*VIDEO* 2023 07 27 iGold Precious Metals Intelligence+ 380

*VIDEO* 2023 07 20 iGold Precious Metals Intelligence+ 379

Soar Financially Interview