Author: Christopher Aaron

*VIDEO* 2023 07 13 iGold Precious Metals Intelligence+ 378

Gold vs. US Bonds and Dow Jones Industrial Average + SPECIAL $1 TRIAL OFFER

Gold Price Forecast: Ominous Signal Says Gold Top in 2024

There is an ominous signal within the precious metals complex which warns that gold may form a significant multi-year top within the next 12 – 18 months. This does not mean one should abandon the sector altogether, as holding some gold is always prudent as an emergency hedge or portfolio insurance. However, the topping signal does suggest that investors should consider ways to mitigate downside risk going forward, as a decline of hundreds of dollars per ounce or more should be in store for mid-decade and beyond.

In the following article, we will discuss the negative signal now appearing and highlight ways to mitigate downside risk as an investor.

Click HERE to continue reading for free on our partner site, Gold Eagle…

*VIDEO* 2023 07 06 iGold Flash Update – Provenance Gold

*VIDEO* 2023 07 06 iGold Precious Metals Intelligence+ 377

Gold Price Forecast + Downside Protection

Downside protection from Colibri Resource Corp (CBI.V – Canada / CRUCF – USA):

+Upside potential

+10% interest earned per year

+Downside protection

*VIDEO* 2023 07 02 iGold Introduction to Convertible Debt – Colibri

*VIDEO* Colibri 2307 – Introduction

*VIDEO* 2023 06 29 iGold Precious Metals Intelligence+ 376

*VIDEO* 2023 06 22 iGold Precious Metals Intelligence+ 375

*VIDEO* 2023 06 15 iGold Precious Metals Intelligence+ 374

*VIDEO* 2023 06 08 iGold Precious Metals Intelligence+ 373

*VIDEO* 2023 06 01 iGold Precious Metals Intelligence+ 372

*VIDEO* 2023 05 25 iGold Precious Metals Intelligence+ 371

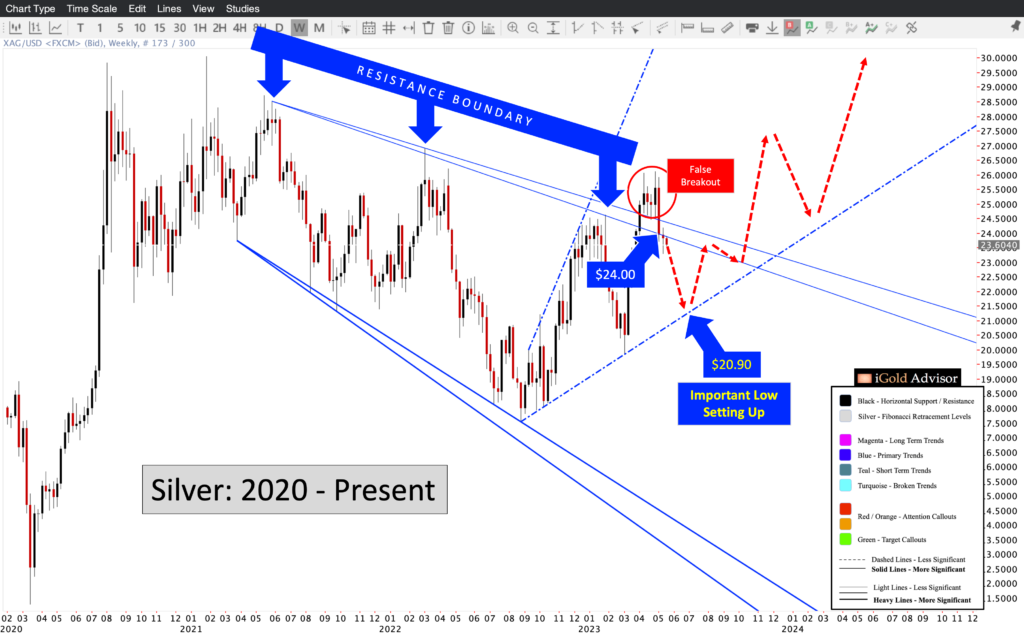

Silver Price Forecast: Important Low Setting Up…

Silver has just witnessed a rare false breakout. A false breakout is when a market overcomes a defined level of selling pressure, only to fail to hold above that level following a period of consolidation. The result after a false breakout is often lower prices; however, context is key, as the market should only be expected to fall to the next visible support level.

In this article we will highlight silver’s recent false breakout, the expected support level it should decline toward, and the price trajectory pending following the summer low.

Click HERE to continue reading for free on our partner site, Silver Phoenix…

True Earth History & Pleiadian Message

Silver Price Forecast + Breakout Update

*VIDEO* 2023 05 18 iGold Precious Metals Intelligence+ 370

*VIDEO* 2023 05 11 iGold Precious Metals Intelligence+ 369

Gold Price Forecast: New All-Time Highs!

Following Wednesday’s Federal Reserve meeting and ¼ point interest rate hike, gold prices reached a new all-time record high: $2,079 in the spot market. This eclipses the previous record of $2,074 set in 2020 by $5 per ounce. While mainstream observers may not be paying attention to the message of the gold market, this new all-time high is a prelude for significantly higher prices to come. Gold is speaking loud and clear: there is trouble in the global economy.

Investors should be finalizing their precious metals portfolios now, because once gold has broken out to record territory, it will be too late to prudently enter the market. Investors seeking leverage to the gold price over the coming year should consider gold mining companies, which are significantly undervalued versus the metal itself.

Click HERE to continue reading for free on our partner site, Gold Eagle…

Gold Price Forecast – New All-Time Highs!