What Affects the Price of Gold?

A Historical Perspective

Gold has been a part of the human story since the dawn of civilization. One part store of wealth, one part ornament, and one part modern technology, gold stands at the crossroads of multiple financial, religious, and industrial trends.

What actually drives gold prices? Is it fear of currency devaluation or stock market crashes? Is it war? Or is it jewelry and electronics fabrication?

The answer is many-fold. In this article, we will highlight the complex and inter-related drivers for gold prices worldwide so that investors may have a fuller understanding of the totality of the precious metals market.

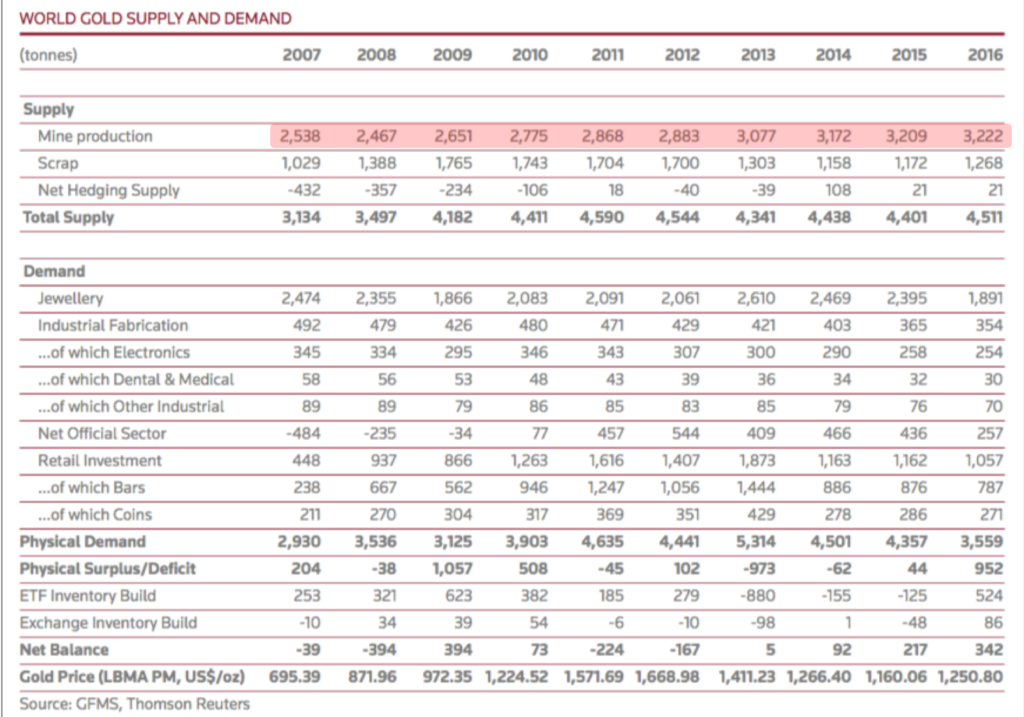

Gold Supply and Demand

Fundamentally, the answer to what affects the price of gold is the same as for every other market: supply and demand.

Yet the supply and demand balance for gold, a market which dates back to the dawn of record-keeping itself, is itself largely driven by factors which are deeply ingrained in the human psyche.

Two extreme emotions – greed and fear – comprise the spectrum through which the majority of participants in the gold market make their buy and sell decisions.

In this article we will examine the many ways in which greed and fear play out, over and over again, in the most ancient of financial markets which is yet seeing new life today.

Gold Supply

Before we examine the actual numbers, let us consider one important preliminary supply factor for gold: this is the only element in which all of the supply ever mined in the history of the world still exists above ground. Gold never rusts, tarnishes, corrodes, or burns. Except for small amounts which may have been lost in shipwrecks at the bottom of the ocean or disposed of in landfills, all of the gold that has ever been brought to surface of the planet still exists in one form or another (and arguably, those two sub-components are retrievable as well).

Click here to continue reading for FREE on our partner site, Gold Eagle…