On War and Gold

Many who have arrived at this site know that in addition to being an active analyst of the precious metals markets, I am also an outspoken critic of the US and Western involvement in the wars in Afghanistan, Iraq, and beyond. If you care to read about my involvement in the wars, please refer to this New York Times article, in which I was featured in 2018:

During the first part of my career I worked in the US Intelligence Community, including time at the Central Intelligence Agency (CIA) and other branches within the Department of Defense (DoD). I served two deployments to both Afghanistan and Iraq from 2006 – 2009, primarily working on the predator drone program. I am a patriot — but also a realist, having experienced the drivers and consequences of these wars firsthand.

Now a member of the organization Veterans for Peace, I am often asked the question: how did you make the transition from military intelligence to analysis of the gold market?

For those who desire to know a little more about the connection between these two areas, the following is submitted for your consideration.

—–

The short answer to the above question is: gold stands in the way of government’s ability to conduct perpetual warfare. It is only in the modern era of purely un-backed fiat currency that world governments are able to engage in ceaseless and unwinnable war far beyond their economic means.

Both modern and historical accounts will show this. Indeed, let me repeat again in no uncertain terms: a government that must pay for its spending with a currency backed by either gold, silver, or any other tangible commodity cannot engage in perpetual war, because it cannot possibly tax its citizens sufficiently to pay for these war expenditures.

Gold is a fiscal-discipline enforcer of balanced government spending, and for this reason, throughout history, governments have attempted to distance themselves from its limitations. However, again universally throughout history, governments who attempt to spend more than they collect via taxation have this discipline imposed upon them by the gold market itself.

Such has happened over and over again throughout the last 5,000 years, and it is happening again today.

Properties of Gold

I began to study the gold market in the mid 2000’s, around the same time that I witnessed firsthand the unwinnable nature of the US foreign wars.

Throughout most of recorded history, gold has served as money.

It is not perfect in this capacity, but it is the best that we have seen as a society thus far. Many other things have been tried and found to be inferior to gold for the purpose of money, such as seashells, gem stones, and paper. However, time and time again throughout history, societies return to gold as a store of wealth.

A few of the reasons why people have found gold to be well-suited for storage of wealth include:

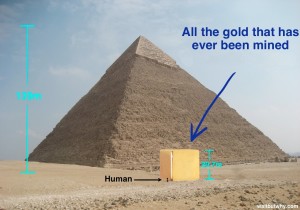

• It is extremely rare. All of the gold ever mined in the history of the world could fit into two medium-sized western houses.

• It cannot be fabricated.

• It never corrodes or rusts.

• Gold is the most malleable of all metals. One ounce of gold can be divided into a sheet of nearly 300 square feet, making it easily divisible.

• It is one of the densest metals, and as such, is extremely difficult to counterfeit.

• Gold maintains its value over decades and millennia.

Compare this to fiat (Latin for “let it be so”) paper or digital money that is printed or electronically created by Central Banks today:

• Loses value every year due to inflation.

• Is often counterfeited.

• Can be printed at will by politicians and Central Banks for insider use.

• Can be electronically stolen / hacked.

• Can burn and/or decompose.

In short, gold is superior to centrally-controlled currency in nearly every facet. It is not perfect, but it is the best that we have found thus far in 5,000 years of civilization.

Gold, the Printing Press, and Inflation

Just as you or I cannot perpetually spend more money than we earn (because eventually our credit cards will be maxed out), governments too cannot perpetually spend more money than they take in through taxation.

That is, unless they control a printing press.

In the modern era, for the first time in recorded history, not a single world currency is backed by any tangible commodity. In other words, each government now controls an infinite money-printing press.

Again, this has never happened before in the history of civilization. It is important to note that profound technological revolutions including the colonization of the Western Hemisphere, the Industrial Revolution, the invention of the steam engine, the telephone, the airplane, and the automobile all happened under a gold standard. Un-backed fiat currency is absolutely not necessary for humanity to achieve progress as a whole.

Through the modern fiat printing press, governments today can tax their citizens — indirectly and obscurely — to pay for things they would not otherwise be able to budget for, such as unwinnable international wars.

This indirect tax is called inflation. While inflation is generally assumed to be a natural process akin to the blowing of the wind or the movement of tides, it is actually a very direct human-created effect.

Inflation is caused by the creation of excess money by central banks.

An Example of Inflation

For example, imagine there are $1 billion dollars in existence, equally divided amongst all citizens. Now imagine the government wants to engage in an international war, and needs to tax all citizens 100% for the full $1 billion to pay for the war.

Obviously, the government would not be able to impose a 100% tax on citizens to pay for the war. There would be a revolt if it tried to do so.

But what if the government instead printed $1 billion new dollars, and spent those to pay for the war instead. What would happen?

Did the government just create new legitimate money out of thin air? Of course not… if it were that easy to create new wealth, the government could simply print all the money it ever needed and never have to tax us for anything ever again. Indeed then, no one would ever have to work if we had a benevolent government that could simply print and distribute new money to its citizens ad infinitum.

So what happened here in our theoretical new $1 billion war expenditure?

The government, by printing this new money, has actually devalued the entire rest of our savings by 50%. Whereas previously there were $1 billion in circulation, there are now $2 billion. Yet the same amount of goods and services are still in existence. The government has thus devalued all of our money in exactly the same proportion as if it had taxed us directly by 50%.

It has simply done so in a way that not one person in a thousand is able to recognize.

The result of this inflation is an increase in prices of food, rent, and other necessities of life. That is how we pay for the inflation tax when government spends beyond its means.

And thus, the government can engage in continued overseas war — war that would otherwise have previously drained the Treasury and forced a tactical withdrawal. The government can do so as long as it continues to have a monopoly on the printing press and a citizenry that does not understand that it is being taxed, indirectly, by this means.

Gold as the Enforcer of Fiscal Discipline

Gold stands in the way of reckless government war spending, because a currency that is exchangeable for gold cannot be printed out of thin air.

Books have been written about this historical subject, and my attempt is not to repeat such here. A few brief examples will suffice.

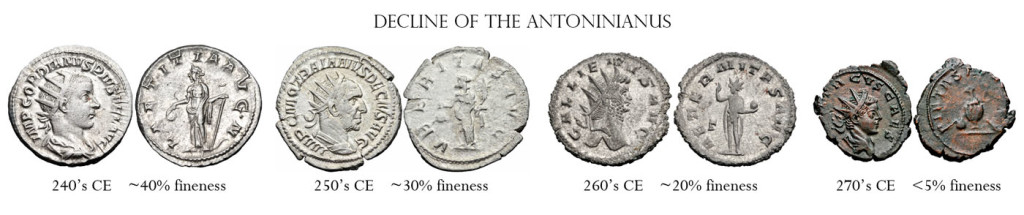

A) One of the primary causes of the decline of the Roman Empire was military overexpansion. During the later stages of the 3rd-century campaign, the leaders of Rome attempted to pay for the wars by fabricating more money out of existing coinage. By diluting Rome’s gold and silver coins and replacing them with copper, they could create 5 or 10 coins where they previously had one. To pay for the war expenses, by the end of the Empire, the gold/silver content of most Roman coins reached nearly zero.

The Empire subsequently collapsed.

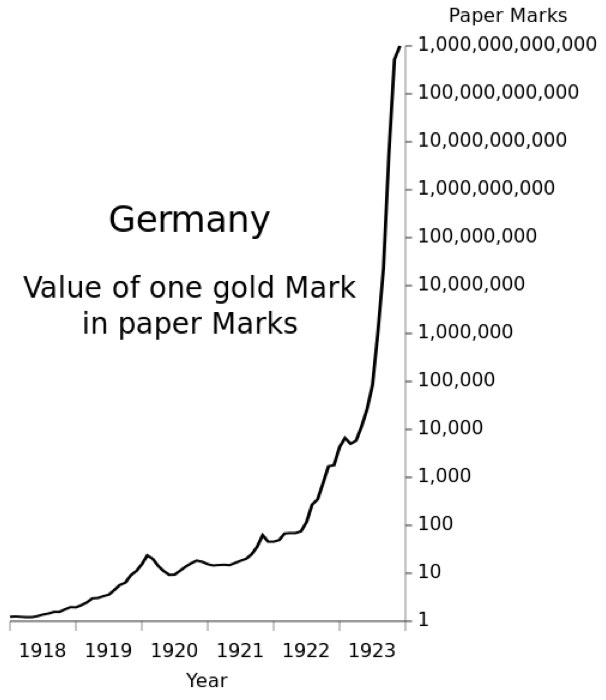

B) After World War I, Germany found itself saddled with  tremendous war debt. In an attempt to repay its creditors quicker than the direct taxation of German gold marks from its citizens would allow, the government began to issue new un-backed currency. From 1914 to 1924, the value of one ounce of gold went from one mark to over one trillion marks, representing the number of new marks printed by the government. By the mid 1920’s, German marks were worth more as kindling in fireplaces than as currency.

tremendous war debt. In an attempt to repay its creditors quicker than the direct taxation of German gold marks from its citizens would allow, the government began to issue new un-backed currency. From 1914 to 1924, the value of one ounce of gold went from one mark to over one trillion marks, representing the number of new marks printed by the government. By the mid 1920’s, German marks were worth more as kindling in fireplaces than as currency.

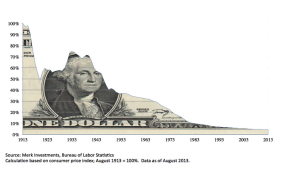

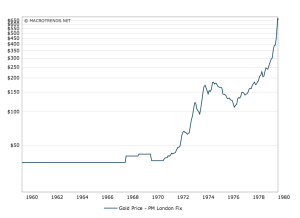

C) Finally, after piling up tremendous debt through engaging in an unwinnable war in Vietnam from the early 1960’s through 1975, President Nixon was forced to remove the US Dollar from its gold backing at $35 per ounce, which had held since 1933. After abandoning the gold standard in 1971, the price of gold rose over 2,400% to $850 per ounce in just nine years, reflecting the devaluation of the US Dollar.

Back to the Present

Since the beginning of the war in Afghanistan in 2001 and the war in Iraq in 2003, the price of gold has risen roughly 725%, from $250 per ounce to $2,065 per ounce.

Just as in other historical periods of unwinnable international war, the gold price over the last 20 years is telling us something: our government is printing money to pay for what it cannot afford.

In doing so, the government is stealing from those who save in US Dollars by debasing the purchasing power of their saved money. Just as in the example of the Roman coins above, the current chart of gold as priced in US dollars is reflecting an increase in currency without the backing of any monetary asset.

This has been tried over and over throughout history, and every single time it has failed.

It is said that those who fail to learn from history are doomed to repeat it. Will we learn?

As a society, we will probably not act until serious damage is done.

Yet for individuals who can read the warning signs, there is still time to take protective action.

The Perpetual War

The United States and major Western allies are now engaged in what can only be called perpetual war.

For the first time in US history, the pretext has been given for our country to be engaged in preemptive overseas wars without end.

I have seen with my own eyes the unwinnable nature of the wars in Iraq and Afghanistan. Indeed, from my first deployment in 2006 through my second in 2009, I noticed an increase in attacks on bases, increased suicide bombers, loss of control over vast regions of the countries, and a decrease in stability in Kabul and Bagdad. This, despite the ‘successes’ of daily kills or captures of senior Taliban or Al-Qaida leaders through ground battles, predator drone strikes, or larger bombing campaigns.

I was there on the ground. I saw the decrease in stability with my own eyes.

We cannot change radical ideology by shooting missiles at individuals and their families. For every one senior Taliban or Al-Qaida commander we kill, we spawn 10 more who hate us.

The children who witness the executions of their leaders, teachers, or family members grow up to be the next generation to hate us. We are making things worse, not better, by these continued callous wars.

Perpetual war — it is a concept not many of us can fully comprehend. But by all measures, it appears that the rationalization has been given for the United States to be engaged in continuous war for the rest of our lives and beyond.

The tremendous human costs of war are something I discuss regularly in other forums, but such is not the focus of this article.

The purpose of this piece has been to show the link between our perpetual wars and precious metals.

Executive Summary

Gold stands in the way of perpetual war.

When a currency is backed by gold, it halts the excessive spending by the Treasury for unsustainable overseas war.

When a currency is not backed by gold, gold rises in price to signal a warning sign that the currency is being devalued. Such is what we have observed in the price of gold over the last 18 years.

Perpetual war is here. While the government can dilute your savings of US Dollars to pay for it, it cannot dilute gold. The importance of this distinction is critical for both individuals and institutions to understand now, and for the duration of the US policy of continuous international war.

-Christopher Aaron

Former CIA & DOD Intelligence Analyst

Founder, iGold Advisor