Are Gold Shorts About to Be Punished?

A recent feature on the Korelin Economics Report, where I discussed with host Corey Fleck the gold market, fundamentals vs. technicals, and ratio analysis for the mining sector: Click HERE to listen on KE Report.

Today we focus closely on the price of silver, and the likelihood for an important low to be forming this spring. Also, an examination of the potential shown by the XAU to silver ratio.

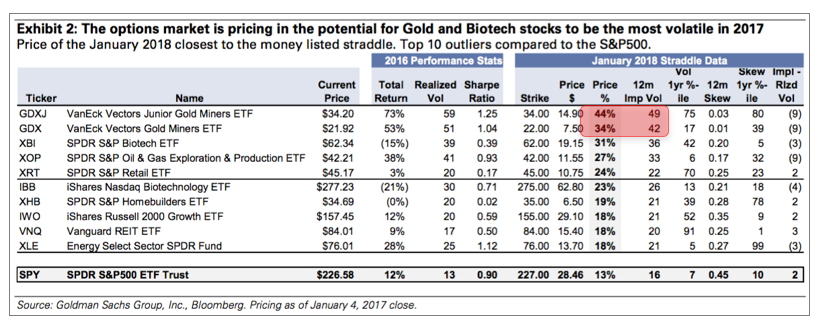

The options market is pricing in that the precious metals equities will be the most volatile sector in the world in 2017. What should investors expect and what are some good strategies for navigating this volatility?

Today we look at updates in the gold and silver price, as well as how the US Trump vs. Clinton election might impact the currency and precious metals markets.

Today we focus on the recent technical and sentiment indicators in the gold and silver mining complex. What should we look for to indicate a bottom is forming?

Gold has broken lower through two important support levels over the last few days. Where may the next low form?

What are the levels we should monitor that would alert us to a technical failure in the precious metals long-term thesis?