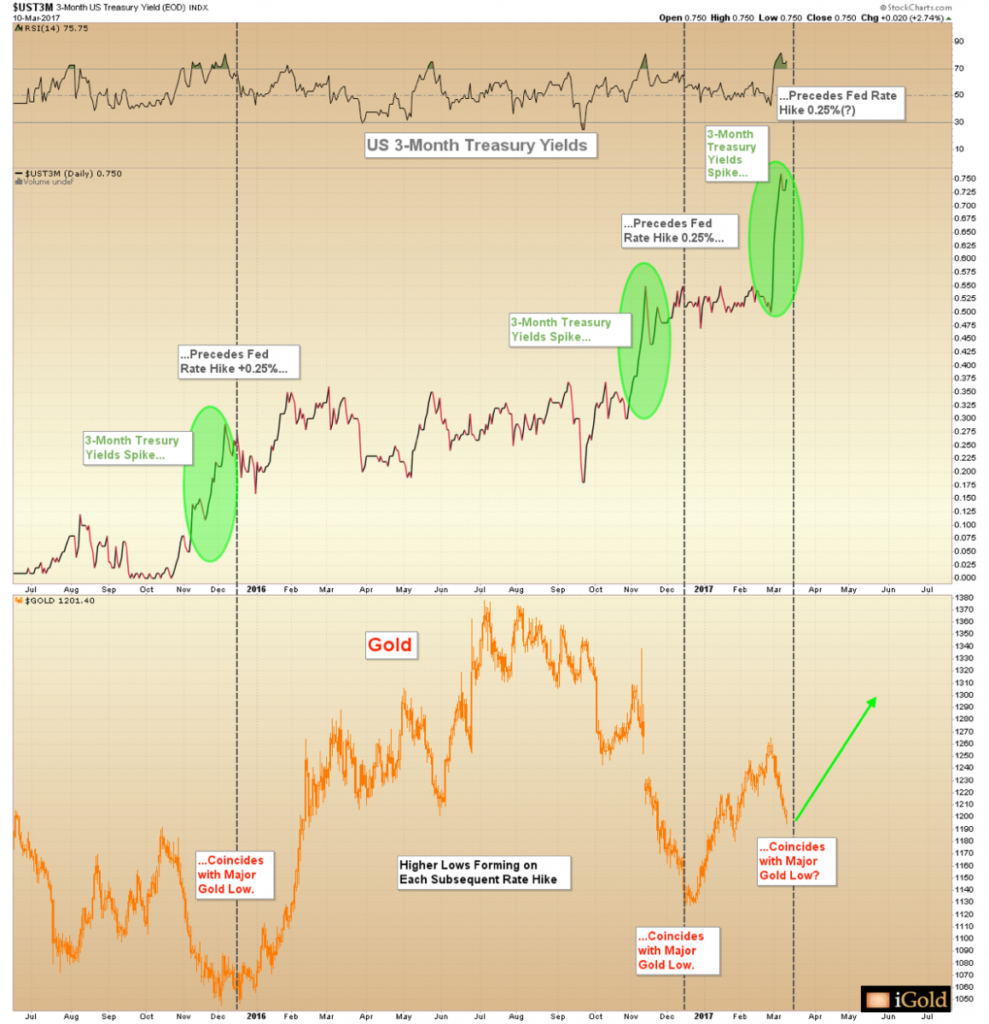

In the aftermath of the unexpected Trump victory, there is a warning signal showing up in the precious metals markets that investors should be aware of. Despite fundamentals that seem to be supportive for gold, the market may be headed for a retest of the December 2015 low of $1,045, or even lower within the next 3-6 months.

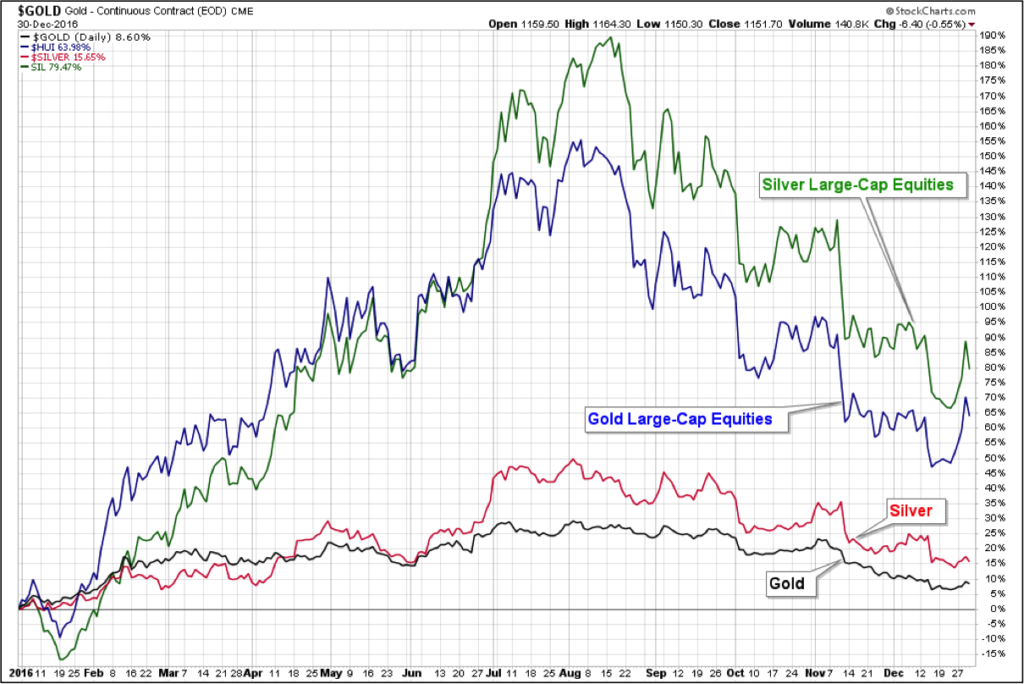

While we remain bullish on precious metals over the long run for fundamental reasons – historic low interest rates, central bank inflation policies, unsustainable debt levels, and unwinnable international wars – we are very keenly aware that these fundamentals do not dictate that prices of precious metals must rise.

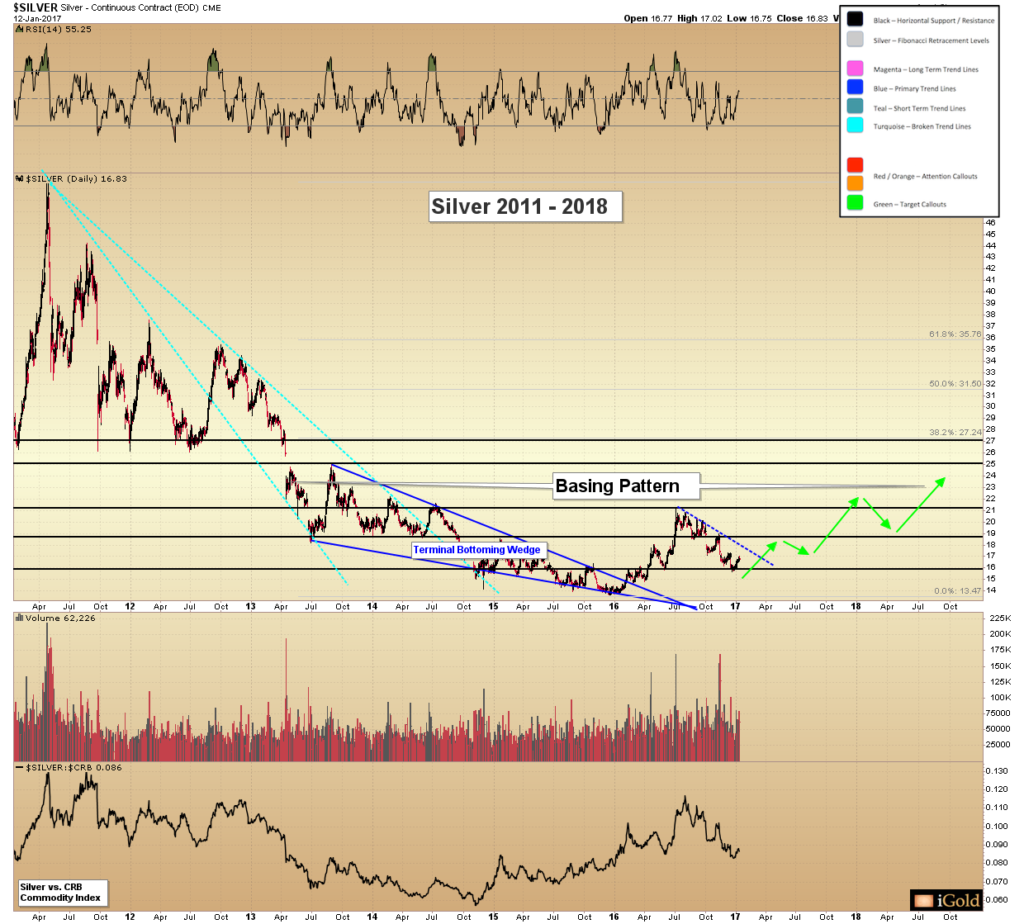

For example, these same fundamentals were true from 2011 – 2015, yet gold lost over 45% of its value with silver losing 65% over the same timeframe. Those who clung to their fundamental beliefs, that the above factors would cause the precious metals to rise, suffered serious losses.

The truth is that markets do not move based on fundamentals over the short or medium-term. Yes, over many decades, gold will retain its value, but over periods less than two decades the incredible swings in the price for gold is caused by the psychology of the market, rather than any specific fundamental.

As investors, we must pay attention to what the market is actually doing, and not what we want it to be doing, if we want to succeed.

To do otherwise is a recipe for disaster.

Click here to continue reading the full article for FREE on our partner site, Gold Eagle…