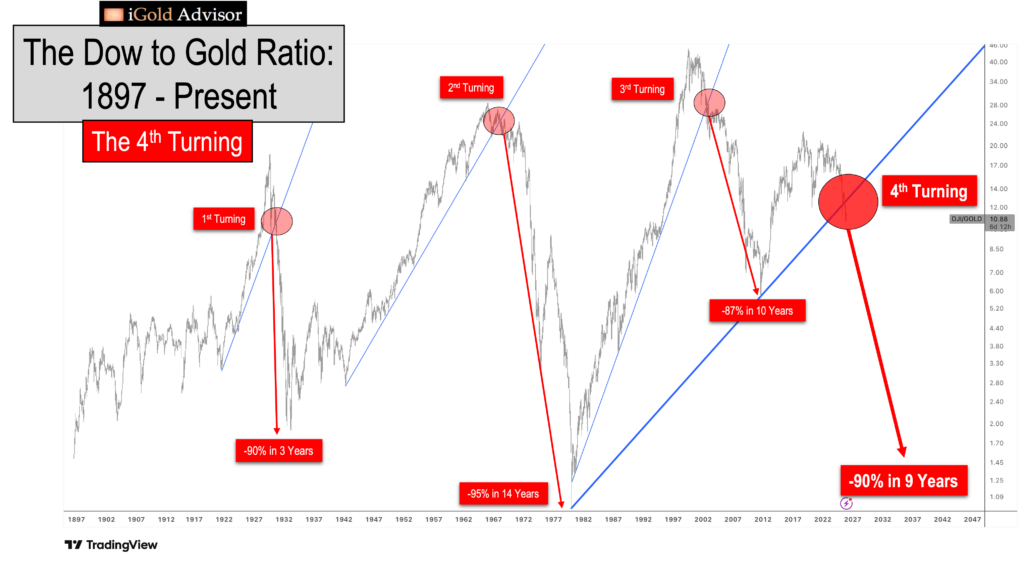

Gold Price Forecast: The 4th Turning Is Upon Us

Gold investors: the fourth turning is upon us.

Yes, that is right – a signal so rare, so powerful, and so ominous that it has appeared only three times in the last 130 years – has now shown itself.

And this signal portends to years of gains ahead for gold – and years of losses ahead for industrial stock (Dow, S&P 500) holders.

This signal is so significant that it will be the foremost tool to guide precious metals investors over the years ahead.

What is the signal?

It is the Dow to Gold Ratio – and it is making only its Fourth Turning of the last 130 years.

Click here to continue reading the full article for FREE on our partner site, Gold Eagle…