Author: Christopher Aaron

Gold vs. Gold Miners Negative Divergence — A Warning

*VIDEO* 2017 08 07 iGold Precious Metals Intelligence 077 W

Silver Manipulation?

Gold Attempts Breakout… Yet Miners Still Signal Caution

Since gold’s all-time high of $1,923 per ounce in September 2011, the nearly 6-year decline that this week has brought prices back to $1,270 has been broadly defined by a falling linear trend of selling pressure. This declining trend is being tested immediately, and a breakout higher would be a major signal that gold’s period of falling prices has come to an end. However, caution is warranted as leading indicators are still flashing warning signals for precious metals prices.

Click here to continue reading for FREE on our partner site, Gold Eagle…

Gold Attempts Breakout as Miners Lag

VIDEO 2017 07 24 iGold Precious Metals Intelligence 075 W

Silver Flash Crash — Bottom?

Premium Subscriber Video: Precious Metals Options

Gold & Silver Price Update – Gold Breaks Support

US Dollar and Gold Positively Correlated — Down

Unfortunately for gold, we are living through one of those anomalous time periods in which the US dollar and precious metals are positively correlated – but to the downside.

Throughout history, gold tends to have its strongest moves when the US dollar is losing value, as gold receives bids from those looking to protect their savings against a decline in the world’s reserve currency.

However, as we can see at right, especially since the Federal Reserve meeting in mid-June, both the US dollar and gold have moved in the same direction: lower.

Click here to continue reading for FREE on our partner site, Gold Eagle…

Gold & Silver Price Update – Prepare for Higher Volatility

Gold Forecast: Caution Advised After Fed Meeting

On the heels of the Federal Reserve’s most recent ¼ point interest rate hike on Wednesday, gold and the precious metals complex have seen a negative bearish reversal that deserves caution over the short and intermediate term.

Fundamentally, the interest rate hike and accompanying policy statement, which indicated that the Fed would begin to taper down its balance sheet over the coming year, was interpreted by the market as supportive for the US dollar and negative for gold. As precious metals investors, we know that the Fed has already printed nearly $4 trillion dollar of fresh liquidity in support of the financial system over the past decade, and that the feasibility of the central bank reducing this liquidity by any significant amount is doubtful. Yet what is important over the short run is not so much our fundamental beliefs – but rather how the market itself is reacting.

For example, those who ignored the actual response of the gold market in 2011 suffered severe losses as the precious metals declined through late 2015. All the while, the Fed continued to print money. The market can move contrary to perceived fundamentals for many years. Caution is again advised at this juncture.

Click HERE to continue reading the full article for FREE on our partner site, Gold Eagle…

Federal Reserve Causes Gold to Tumble

Interview on J22 Report

https://www.youtube.com/watch?v=FcUes0fLtmg

Gold Attempting Major Breakout — But Beware Risks

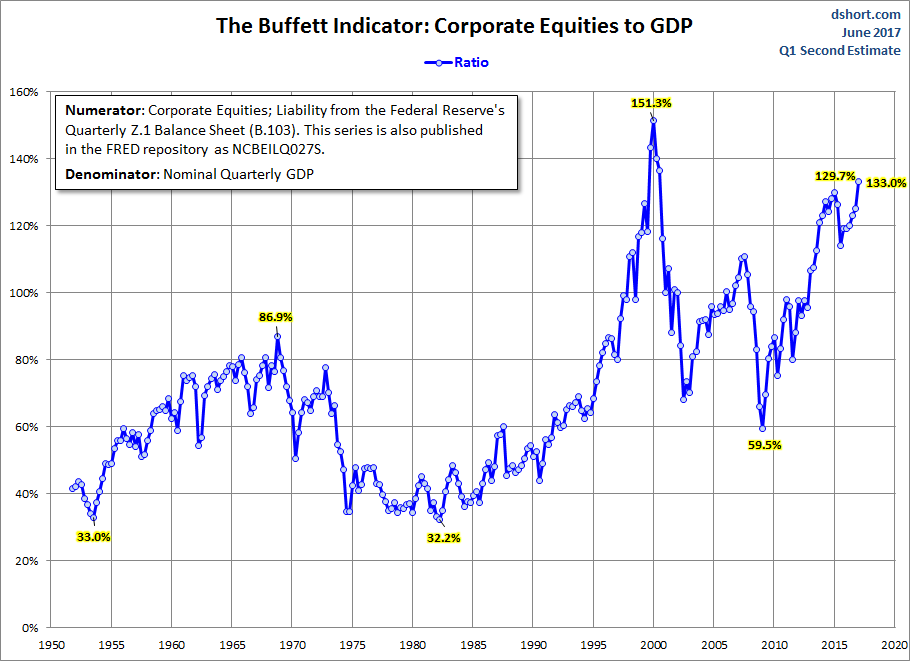

Signs of a top in the US stock market?

US stocks are overvalued by several major valuation models, but is a top near?

Click here to continue reading the full article for FREE on our partner site, Gold Eagle…

Gold & Silver Price Update

Interview with Future Money Trends

Christopher Aaron discusses the state of the gold market with Future Money Trends.

Charting the GDX Gold Miners – Technical Analysis Basics

Key Ratio Hints of Gold Price Breakout

Gold prices remain in a mid-cycle consolidation after the strong advance seen in first-half 2016. Seasonal influences are shaping up for strength by August and September. The gold to silver ratio looks to have topped, signifying an important low across the sector. Precious metals investors should continue to monitor the ratio as a leading indicator, which will give us hints as to the direction of gold’s pending breakout when it occurs later this year.

Click HERE to continue reading the full article for FREE on our partner site, Gold Eagle…

Interview on Korelin Economics Report

Christopher Aaron shares his views on the precious metals and gold mining equities. Click HERE. You may find the interviews by clicking on the “Download Show” links for Segment 5 & 6 on KER.

US Dollar Plunges on Trump Scandal — Gold Surges

Warning in Gold/Silver Ratio

France Elects Macron – What Next For The Euro And Gold Prices?

With France voting for Macron – and by default to remain in the EU – it is likely that fears of a European breakup have seen their worst over the intermediate timeframe. The dollar has received safe-haven status amidst euro fears over the past five years. Dollar strength has put downward pressure on precious metals.

A reversal higher in EUR/USD has begun. The last low in the euro (high in the dollar) of this magnitude marked the relative low in gold at $255 in 2001. Although diverse geopolitical and economic cross-currents will be impacting the gold market over the years to come, the importance of a 16-year cyclical high in the dollar (low in euro) as a backdrop should be at the forefront of long-term precious metals and commodity investors’ minds.

Click HERE to continue reading the full article for FREE on our partner site, Gold Eagle…