Gold Price: Record Breaking Volume in 2017

It is often said that in market analysis: “volume precedes price movement.”

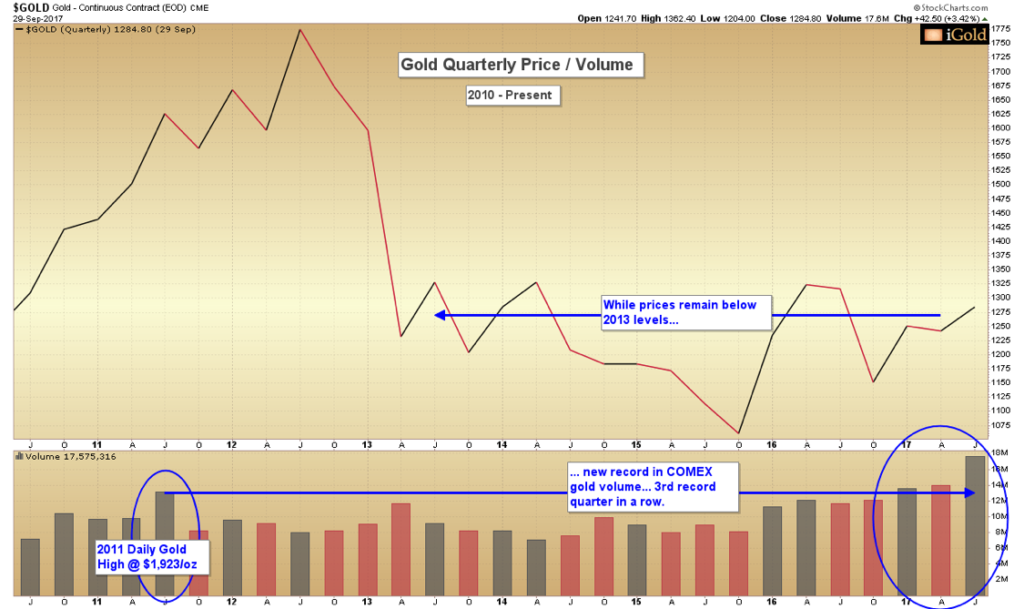

Gold has just posted its highest quarterly volume of all time for futures trading history, for the quarter ended September 30. The closing data shows that for the period, over 17.5 million contracts traded hands. This eclipsed the previous record volume by a whopping 3.5 million contracts. What more, the new record surpasses the number of contracts that were traded during the quarter in which gold made its all-time price high of $1,923 per ounce, which came in Q3 of 2011.

Something is happening here in the gold market, for those who would pay attention to the hints now presenting themselves.

Let us examine the quarterly chart:

Gold Remains in Basing Pattern

What is interesting to note is that this volume surge is occurring as prices remain at or below 2013 levels. The volume spikes are happening now, during the final period of what is a 5-year basing process of overall flat prices, since 2013.

Bases are a technical term for generally sideways price action over a lengthy period of time. To the casual observer, it appears as if nothing noteworthy is happening in the market. Prices rise and fall, and then they rise and fall again, and the mainstream investor begins to lose interest.

Yet underneath the surface, the volume spikes occurring in 2017 tell us that something significant is happening: an acceleration in the transfer of gold from weak hands to strong hands.

Gold Technical Analysis

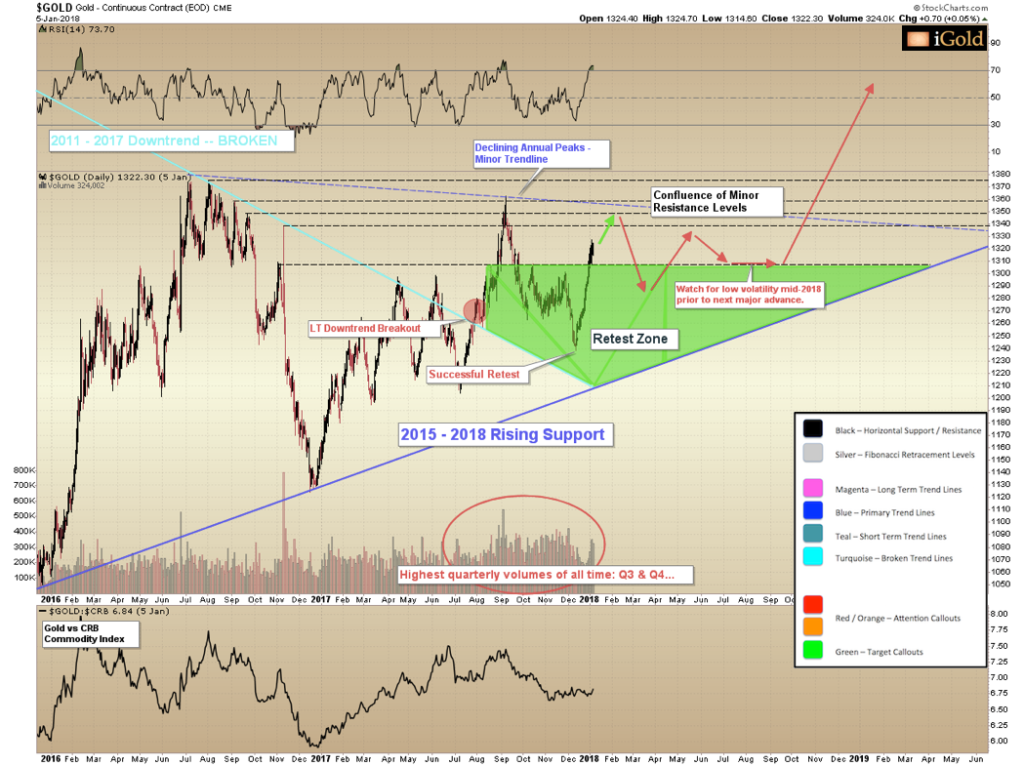

Turning to the daily price chart since the aforementioned 2011 peak in prices, the most important point for us to remain focused on is that gold has broken its long-term 2011 – 2017 downtrend (magenta) and is now retesting that breakout (green shading). This was a clear and strong resistance trend for gold over the past six years, and so a significant advance following a successful retest is to be expected.

Yet we must remain open to the range of scenarios that are possible within the technical model, and for that we must again bring up the longer-term 2011 – present gold chart:

The “must hold” level for gold is thus defined as $1,240, and falling each week. This is the price level where the broken downtrend would be today if it had held. If this level were to fail, the entire breakout would be invalidated, which would have extremely bearish implications for gold prices for several years into the future. We place the probability of this negative scenario as low, given the magnitude of the resistance that had to be overcome by sufficient buying pressure over the past year to break the downtrend. Those buyers should show up again as prices retreat to the breakout zone.

Our 18-month target remains a range between $1,485 – $1,535, as discussed in this recent article (LINK: http://news.gold-eagle.com/article/gold-price-forecast-breakout-underway/727). To summarize the main expectations now over the near-term:

Primary Gold Scenarios – referenced on chart above

Scenario (A) – Higher Retest – gold does not make a full retracement back to its broken long-term downtrend, and instead finds support near current prices of $1,270. Such would indicate buyers positioning aggressively for the anticipated breakout advance. We would thereby expect our primary target of $1,485 – $1,535 to be reached by Q1 2018.

Scenario (B) – Lower Retest – gold does make a full retracement back to its broken long-term downtrend, falling to $1,240 (or slightly lower if it occurs after a further delay). Such would indicate the weakest possible advance trajectory. The breakout targets would remain valid, yet buyers would not be showing strong conviction. We would thereby expect our primary target of $1,485 – $1,535 to be reached by end-2018 / Q1-2019.

In sum, the level of the retracement now being observed will give us a strong showing for how aggressively buyers are stepping into the market on the retest, and thus how quickly the technical targets should be reached. The target remains the same in either scenario; it is the timing that will vary.

Takeaway on Gold Prices

Record volume is being observed in the gold market in 2017, even as prices have not moved significantly from where they were five years ago. This increase in volume is signifying increased interest in gold as a basing process is progressing.

Gold has already broken its long-term downtrend. The next confirmation of a sustained advance will come when 2016 highs are exceeded.

But investors should not be chasing price spikes higher after that occurs. Risk of a more significant pullback will increase once gold begins to approach the above targets.

Finally, as this basing process continues we believe that there is great risk of certain investors getting “washed out” of the precious metals market just prior to a major advance if they do not view this price action with a proper technical lens. We will continue to monitor the downtrend retest as it occurs, and look for volume to remain strong when 2016 highs are re-challenged.

Link to original post: http://news.gold-eagle.com/article/gold-prices-record-breaking-volume/780