Gold & Silver Price Update – Negative Warning Again

The gold price has been strong recently, having risen over $180 from the August 2018 low of $1,167 to the peak above $1,347 as of last week.

There have been solid fundamental reasons for gold’s run: primarily, the Federal Reserve last month hinted that it may not continue raising interest rates, as it had been assuring it would over the past three years. Such in turn has been considered a sign that the Fed may in fact reverse course and begin cutting rates later this year, which is generally considered negative for the value of the dollar and positive for precious metals.

However, are these fundamentals enough to keep bullion’s run alive? Will this market narrative continue going forward?

Despite the recent performance, one of our proprietary technical indicators is flashing a major warning signal for those who follow the language of the charts. Specifically, gold is showing a sell signal witnessed only four times over the past eight years. This warning signal coincided exactly with the absolute peak in gold at $1,923 in September, 2011. This same signal appeared again in January 2013, immediately before gold fell $500 from $1,680 down to $1,180 over just six months.

So reliable has this signal been, that it has never occurred without gold falling at least $130 over the subsequent six months.

Click here to continue reading the article for FREE on our partner site, Gold Eagle…

Walls have been in the news a lot lately. Walls which may be built, walls which may not be built.

Yet for all the talk of walls these days, there is one wall that precious metals investors should be focusing on foremost. And no, it has nothing to do with the southern US border.

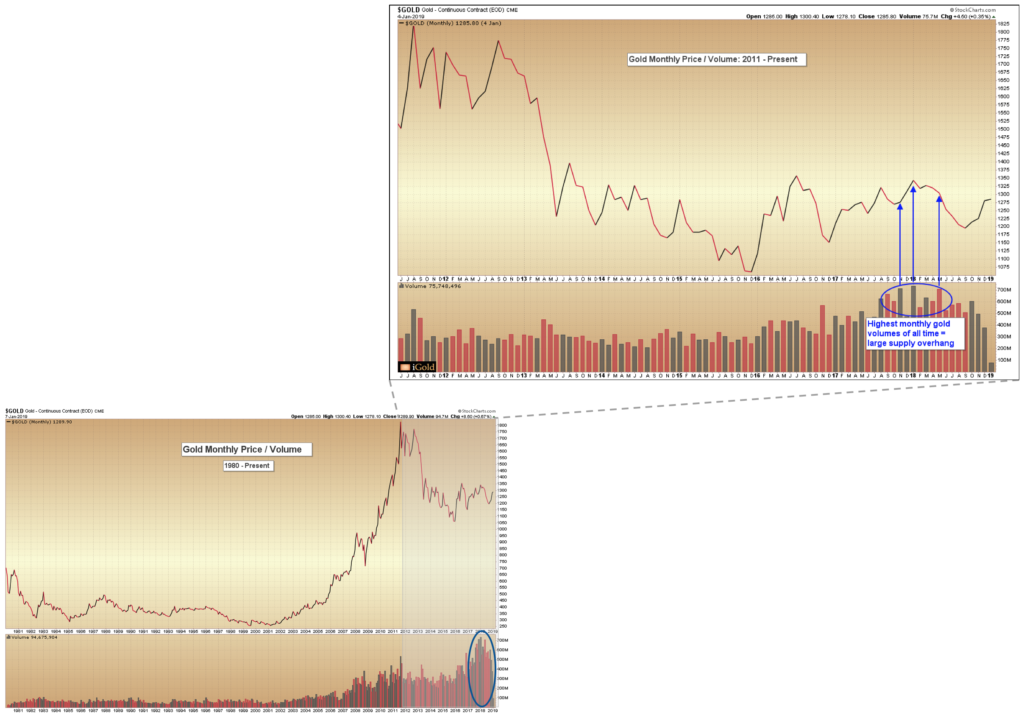

Instead, the barrier we are referring to is the wall of sellers who will be showing up in the precious metals as gold approaches $1,300 per ounce.

What are we referring to, specifically?

Let us examine the visible data.

Click HERE to continue reading for free on our partner site, Gold Eagle…

What is next for both the stock market and gold? Is now the time to buy gold for protection against a stock market crash?

Let us evaluate the structure of both these markets and discuss protection strategies.

Click HERE to continue reading for free on our partner site, Gold Eagle…