Author: Christopher Aaron

Silver Price Update – Breakout Trigger

Gold Price Forecast: Pullback Ahead as Gold Approaches $1,800

Gold has been strong recently on the heels of Coronavirus fears, Federal Reserve stimulus packages, and continued geopolitical tensions, which are now being exacerbated by the George Floyd riots in the United States.

Gold is up by $57 for the month of May to close at $1,731 in the spot market as of Friday afternoon. The metal is higher by $155 for the quarter thus far and $228 for the year 2020, which is not yet half over.

That said, in the markets as in life, nothing moves in a straight line forever. We have reason to believe that following some further gains during the month of June, gold is due for a multi-hundred dollar pullback that could coincide with the next wave of Coronavirus-related debt defaults.

Let us study both the long-term and short-term price action for gold to arrive at the highest-probability trajectory for the remainder of 2020.

Click here to continue reading for FREE on our partner site, FX Empire…

*VIDEO* 2020 06 01 iGold Precious Metals Intelligence 222

*VIDEO* 2020 05 25 iGold Precious Metals Intelligence 221

Gold Price & US Stock Market – Global Depression Update

Gold Price Forecast: Twice Per Century Signal Says Depression Ahead

A signal has just appeared in the global financial markets which has only been witnessed one other time in recorded history – and it foretells of immense trouble for the world economy ahead.

What is the signal?

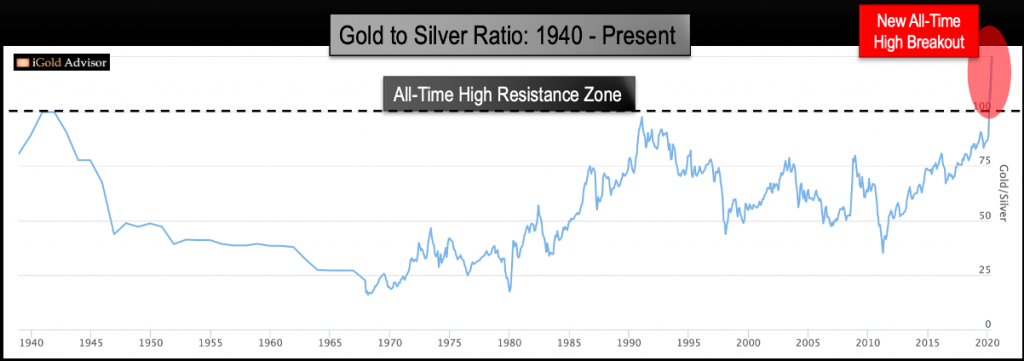

The gold to silver ratio – it has just shattered its former all-time highs.

When is the only other time in history that the gold to silver ratio has broken out to a new all-time high?

At the start of the Great Depression, in 1930.

Click here to continue reading for FREE on our partner site, Gold Eagle…

*VIDEO* 2020 05 18 iGold Precious Metals Intelligence 220

*VIDEO* 2020 05 11 iGold Precious Metals Intelligence 219

Gold Price Update – The Battle for $1,800

*VIDEO* 2020 05 04 iGold Precious Metals Intelligence 218

Global Market Crash? Gold Price Update

*VIDEO* 2020 04 27 iGold Precious Metals Intelligence 217

*VIDEO* 2020 04 21 iGold Flash Update

*VIDEO* 2020 04 20 iGold Precious Metals Intelligence 216

Gold & Silver Price & Strategy Update

*VIDEO* 2020 04 13 iGold Precious Metals Intelligence 215

Gold Price Forecast: A Significant Top Is Ahead

While those without any precious metals exposure whatsoever would be wise to establish a core holding as an insurance policy against unprecedented central bank monetary debasement, there are important warning signs appearing within the market which show us that precious metals may be due for a significant retracement of the recent gains. It is possible that the retracement may start following one final surge; however, our highest expectation remains that gold is due to give back at least several hundred dollars of its recent advance within the coming year. Investors should be careful about chasing recent price gains.

Click here to continue reading for FREE on our partner site, Gold Eagle…

Gold & Silver Price Update – Coronavirus Strategies

*VIDEO* 2020 04 06 iGold Precious Metals Intelligence 214

*VIDEO* 2020 03 30 iGold Precious Metals Intelligence 213

Gold & Silver Price Update – Coronavirus – Stock Market Crash?

*VIDEO* 2020 03 23 iGold Precious Metals Intelligence 212

Coronavirus / Gold / Silver / Stock Market Crash