Author: Christopher Aaron

Silver Price Forecast – Blast Off

*VIDEO* 2020 08 24 iGold Precious Metals Intelligence 234

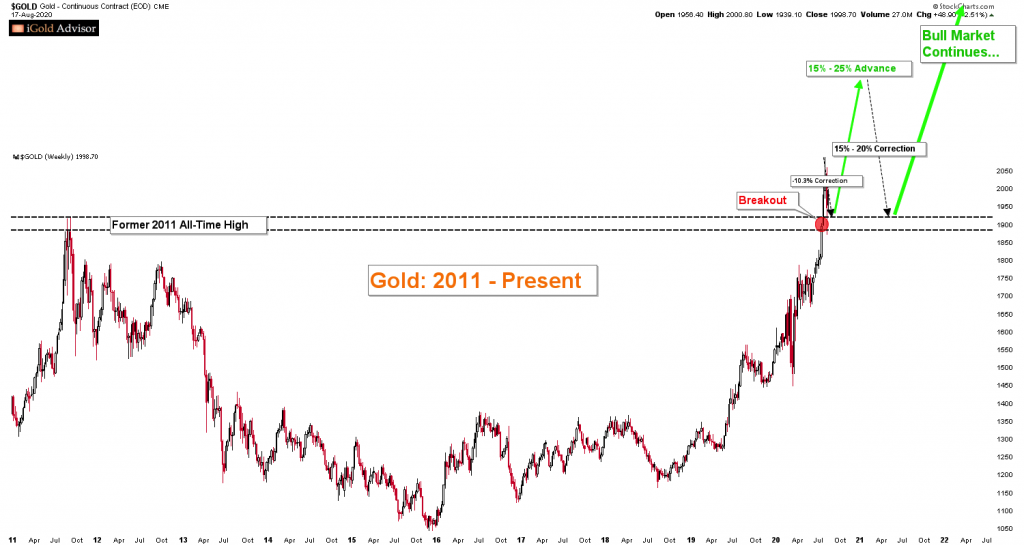

Gold Price Forecast: All-Time High Breakout Underway

Gold has just broken out to a new all-time high, eclipsing the former peak of $1,920 set on September 6, 2011. As this article is going to press, gold is trading at $1,983 in the worldwide spot market.

This is a huge moment for gold. All-time highs do not occur every day, nor every year, nor even every decade for the historic store of wealth.

What now? Will gold make a second long-term peak as it did in 2011 and enter another multi-year decline? Or is there a sustainable bull market ahead?

In this article, we will examine the historical precedents for gold as it has broken former all-time highs, and then calculate realistic expectations for the price of gold over the next year based on an observable price pattern

Click here to continue reading for FREE on our partner site, Gold Eagle…

*VIDEO* 2020 08 17 iGold Precious Metals Intelligence 233

Gold Price Forecast – Second Half 2020

*VIDEO* 2020 08 10 iGold Precious Metals Intelligence 232

*VIDEO* 2020 08 03 iGold Precious Metals Intelligence 231

US Dollar Collapse? Gold New All-Time High

*VIDEO* 2020 07 27 iGold Precious Metals Intelligence 230

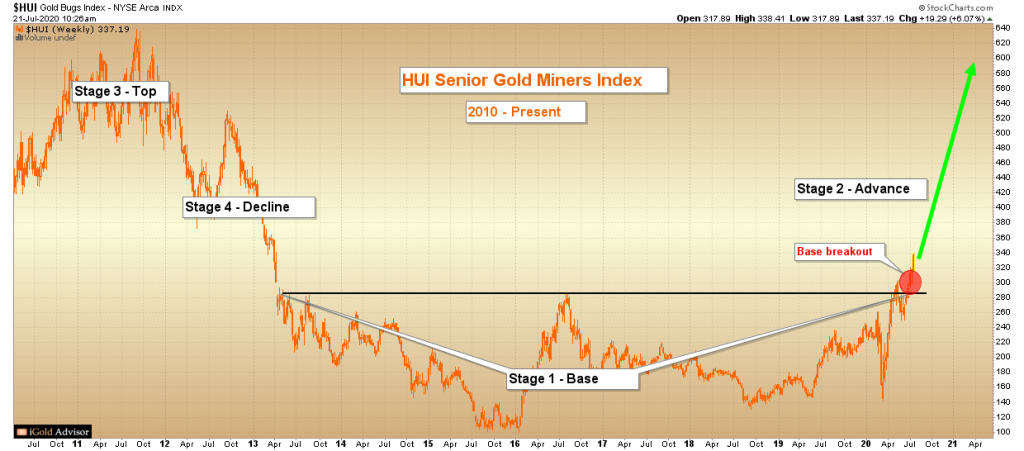

Gold Miners Forecast: Major Breakout Underway

The gold mining complex is breaking out of a large and powerful pattern which suggests years of gains and hundreds of percentage points lie ahead for investors. For those who possess the proper risk tolerance for this type of investing, the time to get involved is now.

Click here to continue reading for FREE on our partner site, Gold Eagle……

*VIDEO* 2020 07 20 iGold Precious Metals Intelligence 229

Silver is Breaking Out

Gold Price Forecast – Testing Strong Resistance

Gold is testing strong overhead resistance just above the $1,800 level. How gold behaves now and over the next several weeks will determine its trajectory for at least the next 18 months.

Click here to continue reading for FREE on our partner site, FX Empire…

*VIDEO* 2020 07 13 iGold Precious Metals Intelligence 228

*VIDEO* 2020 07 06 iGold Precious Metals Intelligence 227

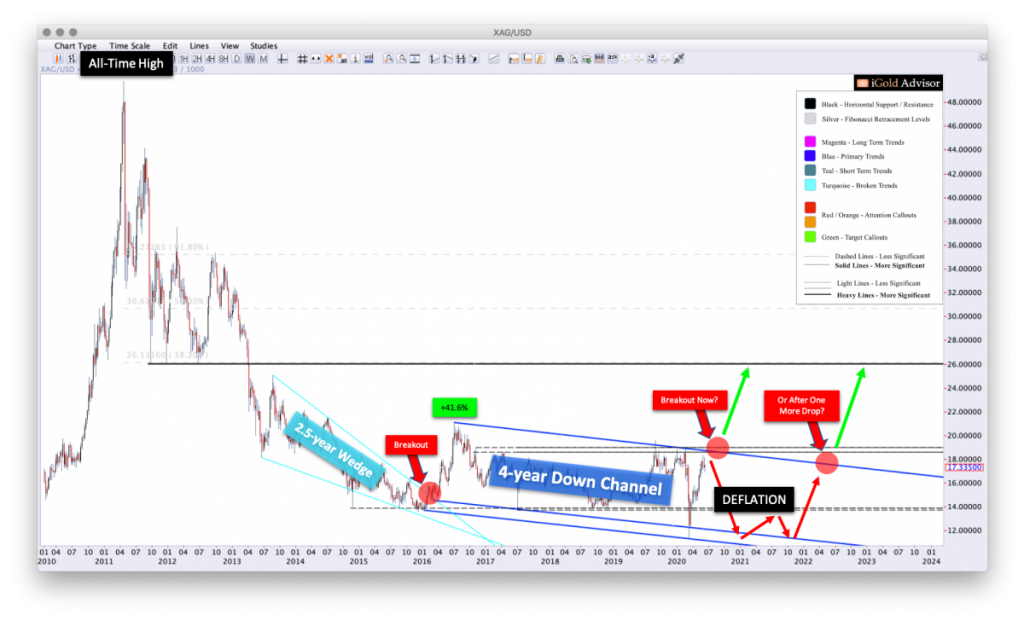

Silver Price & Silver Miners Update – Breakout to $50?

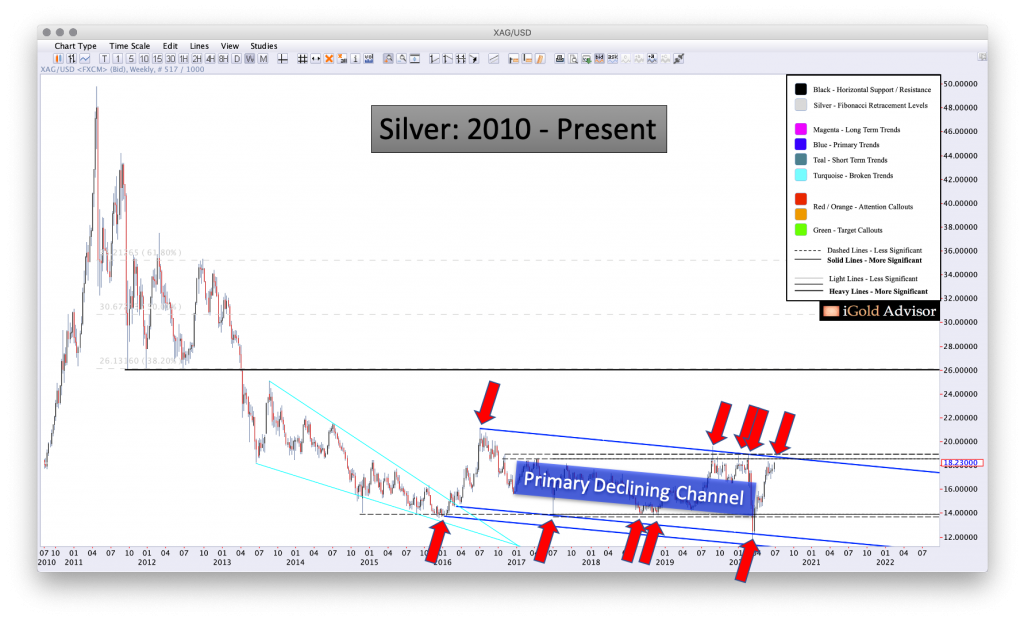

Silver Price Forecast: Major Resistance Ahead

Silver is facing make-or-break resistance at $18.60 spot, a figure which will determine the metal’s outlook for the next 12 – 24 months.

Click here to continue reading for FREE on our partner site, FX Empire…

*VIDEO* 2020 06 29 iGold Precious Metals Intelligence 226

Gold & Stock Market Crash Update

*VIDEO* 2020 06 22 iGold Precious Metals Intelligence 225

Gold Price & Gold Miners Update

Gold Price & Gold Miner Update – June 18, 2020

Silver Price Forecast: Blast-Off or One Final Drop?

For the year, gold is up $213 or 14% to close at $1,737 per ounce as this article is going to press.

What about the “other” precious metal – gold’s cousin – silver?

For the year, silver is down $0.27 cents or 1.5% to $17.65.

A disappointing performance, no doubt.

Is the pain soon to end for silver investors? Will this be the time that silver finally follows gold and heads higher? Or is more languishing ahead?

Click here to read for FREE on our partner site, Silver Phoenix…

US Dollar Forecast: Safe-Haven Until Proven Otherwise

Amidst the S&P 500’s 4.6% sell-off to close the week following the Federal Reserve’s policy decision last Wednesday, which asset was the primary beneficiary? We take a close look.

Click here to continue reading for FREE on our partner site, FX Empire…