Author: Christopher Aaron

*VIDEO* 2021 10 04 iGold Precious Metals Intelligence 288

*VIDEO* 2021 09 27 iGold Precious Metals Intelligence 287

*VIDEO* 2021 09 20 iGold Precious Metals Intelligence 286

*VIDEO* 2021 09 16 iGold Flash Update

*VIDEO* 2021 09 13 iGold Precious Metals Intelligence 285

*VIDEO* 2021 09 08 Elite Private Placements

Gold Price Forecast: Key Support and Resistance Levels

Gold is trading within a giant consolidation pattern. We will look for clues as per which direction the consolidation will eventually resolve based on two key trigger levels: a break above $1,917 would signal a continuation of the 2015 – 2020 bull market, whereas a failure at $1,610 would mean a multi-year bear market is still looming. What our analysis thus shows is that gold should be expected to trade within a nearly $300 range for the foreseeable future, with a much larger move pending within 12 – 18 months.

Let us examine the relevant resistance and support levels for more detail on the range of outcomes:

Click here to continue reading for FREE on our partner site, Gold Eagle…

*VIDEO* 2021 09 07 iGold Precious Metals Intelligence 284

*VIDEO* 2021 08 30 iGold Precious Metals Intelligence 283

*VIDEO* 2021 08 23 iGold Precious Metals Intelligence 282

*VIDEO* 2021 08 16 iGold Precious Metals Intelligence 281

Elite Private Placements Introduction

*VIDEO* 2021 08 09 iGold Precious Metals Intelligence 280

*VIDEO* 2021 08 02 iGold Precious Metals Intelligence 279

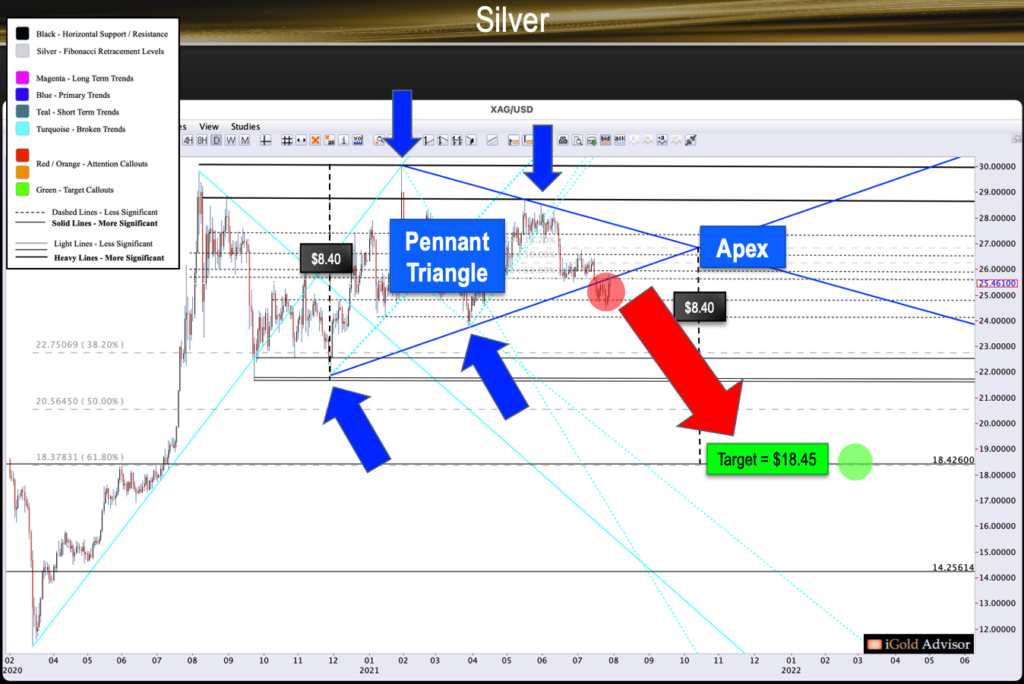

Silver Price Forecast: Back into the Teens?

Silver has been stuck within a rangebound consolidation between circa $22 and $30 for the better part of the last year. Unfortunately, we are now observing signs that silver may be set to decline back as low as the mid-$18 range, before it continues any higher. Two notable signals are lining up to suggest that lower silver prices are ahead.

Click here to continue reading for FREE on our partner site, Silver Phoenix…

FACE Interview

*VIDEO* 2021 07 26 iGold Precious Metals Intelligence 278

Silver Price Update – Breakdown Ahead?

*VIDEO* 2021 07 19 iGold Precious Metals Intelligence 277

*VIDEO* 2021 07 12 iGold Precious Metals Intelligence 276

Gold Price Update – Is the Bottom In?

*VIDEO* 2021 07 06 iGold Precious Metals Intelligence 275

*VIDEO* 2021 06 28 iGold Precious Metals Intelligence 274

Silver Price Update