Author: Christopher Aaron

*VIDEO* 2022 05 09 – Elite Private Placements Member Update

US Dollar Breakout & Federal Reserve Update

*VIDEO* 2022 05 02 iGold Precious Metals Intelligence 317

*VIDEO* 2022 04 26 iGold Precious Metals Intelligence 316

Silver Price Update – Is Silver Breaking Out?

*VIDEO* 2022 04 18 iGold Precious Metals Intelligence 315

*VIDEO* 2022 04 11 iGold Precious Metals Intelligence 314

Gold & Silver Miners – Opportunity of a Lifetime

Gold Price Forecast: Pullback Ahead – How Low?

Gold may be set for a further pullback before a resumption of the bull market is ready. Traders should position for short-term weakness, yet investors should use the dip as a final buying opportunity before higher prices.

Our most significant clue that a pullback may be due for bullion itself comes from the gold mining complex.

Click HERE to continue reading for free on our partner site, Gold Eagle…

*VIDEO* 2022 04 04 iGold Precious Metals Intelligence 313

*VIDEO* 2022 03 28 iGold Precious Metals Intelligence 312

*VIDEO* 2022 03 21 iGold Precious Metals Intelligence 311

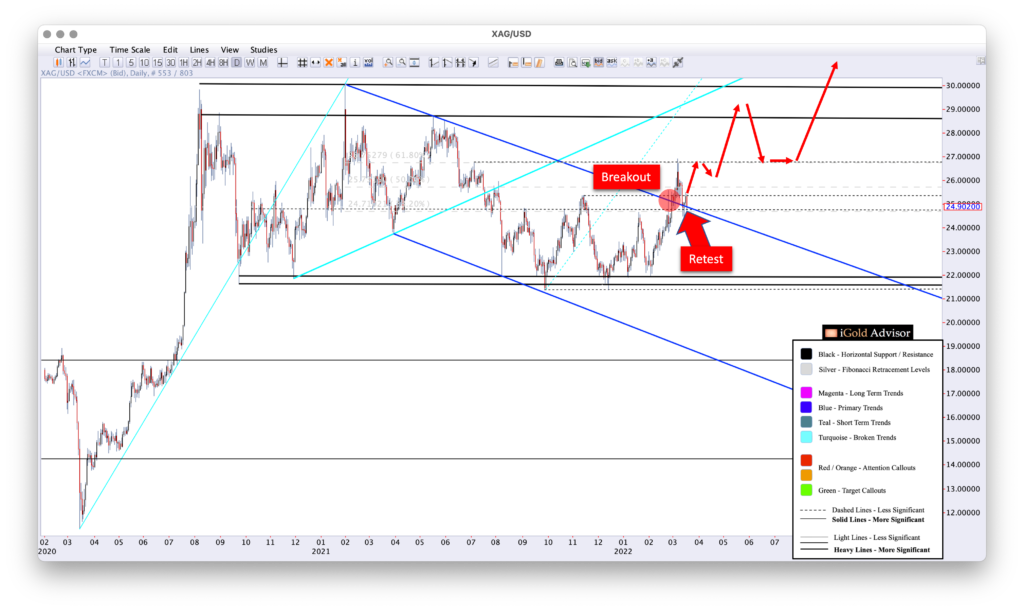

Silver Price Forecast: Upward to $30

In the wake of defensive buying following Russia’s invasion of Ukraine, silver has just triggered a key technical level which now points to higher prices. In this article we will detail the expected moves for silver, referring to the following chart.

Click HERE to continue reading for free on our partner site, Silver Phoenix…

Silver Price and Federal Reserve Rate Hike Update

*VIDEO* 2022 03 14 iGold Precious Metals Intelligence 310

*VIDEO* 2022 03 07 iGold Precious Metals Intelligence 309

Silver Price Update – Breakout Ahead?

*VIDEO* 2022 02 28 iGold Precious Metals Intelligence 308

Stock Market Crash Alert

*VIDEO* 2022 02 21 iGold Precious Metals Intelligence 307

*VIDEO* 2022 02 14 iGold Precious Metals Intelligence 306

Gold Price Update + War in Russia / Ukraine?