Author: Christopher Aaron

*VIDEO* 2023 06 15 iGold Precious Metals Intelligence+ 374

*VIDEO* 2023 06 08 iGold Precious Metals Intelligence+ 373

*VIDEO* 2023 06 01 iGold Precious Metals Intelligence+ 372

*VIDEO* 2023 05 25 iGold Precious Metals Intelligence+ 371

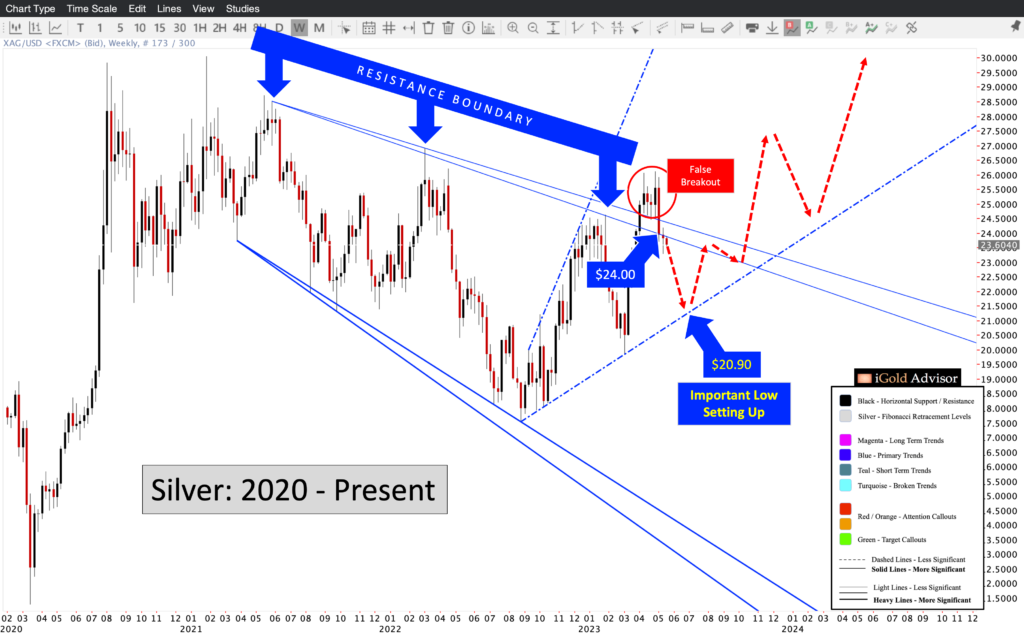

Silver Price Forecast: Important Low Setting Up…

Silver has just witnessed a rare false breakout. A false breakout is when a market overcomes a defined level of selling pressure, only to fail to hold above that level following a period of consolidation. The result after a false breakout is often lower prices; however, context is key, as the market should only be expected to fall to the next visible support level.

In this article we will highlight silver’s recent false breakout, the expected support level it should decline toward, and the price trajectory pending following the summer low.

Click HERE to continue reading for free on our partner site, Silver Phoenix…

True Earth History & Pleiadian Message

Silver Price Forecast + Breakout Update

*VIDEO* 2023 05 18 iGold Precious Metals Intelligence+ 370

*VIDEO* 2023 05 11 iGold Precious Metals Intelligence+ 369

Gold Price Forecast: New All-Time Highs!

Following Wednesday’s Federal Reserve meeting and ¼ point interest rate hike, gold prices reached a new all-time record high: $2,079 in the spot market. This eclipses the previous record of $2,074 set in 2020 by $5 per ounce. While mainstream observers may not be paying attention to the message of the gold market, this new all-time high is a prelude for significantly higher prices to come. Gold is speaking loud and clear: there is trouble in the global economy.

Investors should be finalizing their precious metals portfolios now, because once gold has broken out to record territory, it will be too late to prudently enter the market. Investors seeking leverage to the gold price over the coming year should consider gold mining companies, which are significantly undervalued versus the metal itself.

Click HERE to continue reading for free on our partner site, Gold Eagle…

Gold Price Forecast – New All-Time Highs!

*VIDEO* 2023 05 04 iGold Precious Metals Intelligence+ 368

*VIDEO* 2023 05 03 iGold Flash Update

*VIDEO* 2023 04 28 iGold Scheduling Notice

*VIDEO* 2023 04 24 iGold Precious Metals Intelligence+ 367

Silver Price Forecast + Breakout Update

*VIDEO* 2023 04 18 iGold Precious Metals Intelligence+ 366

*VIDEO* 2023 04 10 iGold Precious Metals Intelligence+ 365

Silver Price Forecast + Breakout Alert!

*VIDEO* 2023 04 03 iGold Precious Metals Intelligence+ 364

*VIDEO* 2023 03 23 Elite Private Placements – EQTY Investor Conference Call

*VIDEO* 2023 03 27 iGold Precious Metals Intelligence+ 363

*VIDEO* Impact Silver 2303 – Introduction

Gold Price Forecast: New All-Time Highs Coming

Gold is on the verge of new all-time highs. The metal of kings has already broken out to new all-time highs in many world currencies – the last yet most important will be gold as priced in US dollars.

On the heels of the 0.25% interest rate hike by the Federal Reserve, yet amidst clear signals that the central bank is ready to print new money to support the financial system after the failures of Silicon Valley Bank and Signature Bank, gold rose $30 or 1.5% to close at $1,970 per ounce in the spot market on Wednesday.

Let us observe gold as priced in several world currencies, so that we may gain a glimpse of what is in store for gold in US dollars over the months ahead.

Click HERE to continue reading for free on our partner site, Gold Eagle…