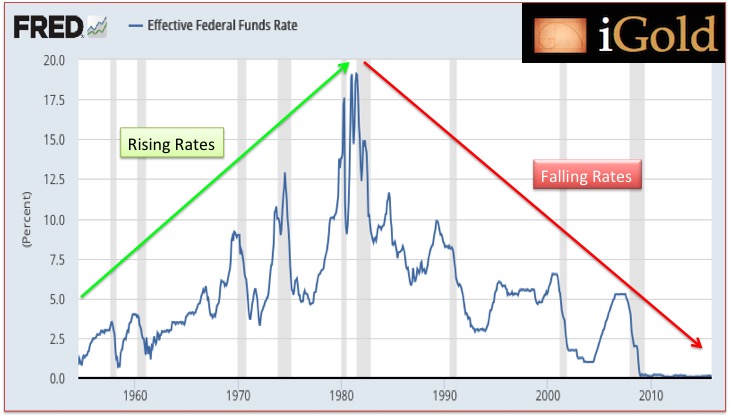

There is much discussion in the financial press regarding the upcoming Federal Reserve meeting on December 15-16 and the likelihood of an increase in the Federal Funds Rate, which has been held close to 0% by the Central Bank since the financial crisis of 2008. The futures market is currently pricing in a significant chance for a rate increase to between 0.25 – 0.50% at the upcoming meeting. This, in turn, has made precious metals investors increasingly nervous in recent weeks, as many have come to believe that rising interest rates mean gold and silver will fall, due to an expected move higher for the US Dollar after the rate hike.

It is time to dispel this myth once and for all. Indeed, in 70 years of publicly available data from the Federal Reserve Board itself, we can very clearly see that rising short-term interest rates correspond to rising precious metals prices. Both recent examples and historic trends will illustrate this point.