The grinding nature of gold’s price action, since the surge in February, has left many investors concerned. Why hasn’t the metal continued to build upon the gains of earlier this year?

Nothing in nature moves in a straight line. Gold, a fundamental element of nature, and the markets, being the sum of human nature, are no different.

Consolidations are very healthy for markets. They represent a shifting of ownership from weak hands to strong.

We view any price action above the bottom end of our green highlighted zone at $1,176 to be an ideal setup for a strong continuation move later this year.

The reason? If gold can consolidate during this — the seasonally weakest period of the year — it will mean new demand is showing up in the market even during the months that we typically expect to see buyers largely absent.

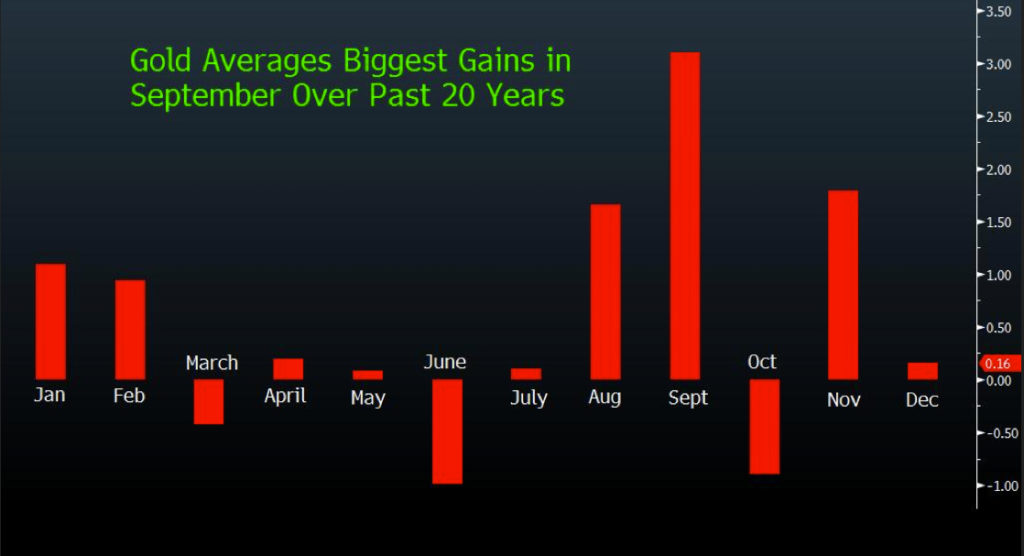

Below we show the gold seasonality chart for the past 20 years. Note that demand typically picks up starting mid/late August and remains rather strong through February. Meanwhile, the March – July timeframe usually represents the weakest season for gold.

This is why we believe that if gold can buck the seasonal trend, and merely consolidate through the mid-summer, the precious metals will actually be showing underlying strength — and will be setting up for a significant rally this fall.

Continue reading the full article for free on our partner site Gold Eagle…