The coronavirus has rapidly taken center stage in world affairs over just the last month. With its terrible human casualties comes a nasty financial side effect: deflation.

The US stock market has just witnessed its worst weekly decline (-11%) since the Crash of 2008.

Oil prices fell more in a single day on Monday, March 9 (-33%) than on any other day in the post-Bretton Woods (1971) era.

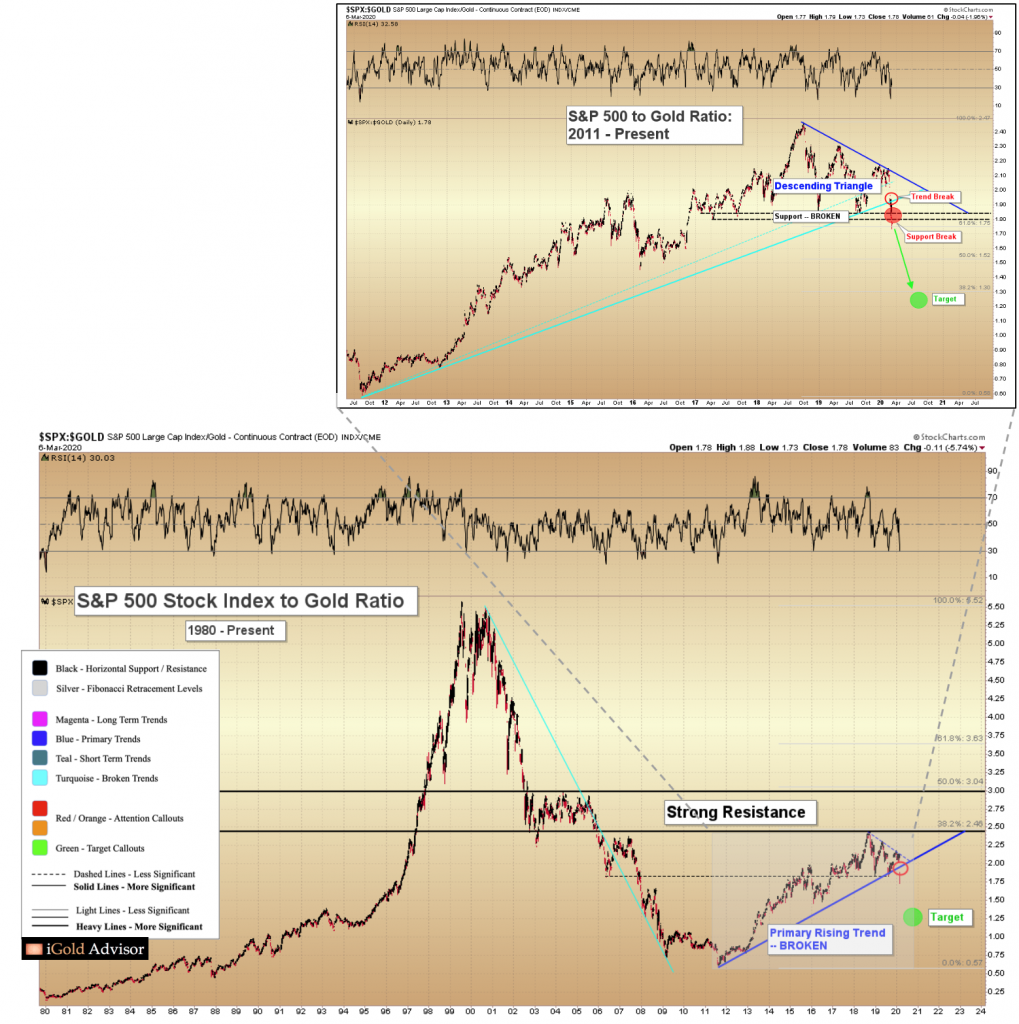

Meanwhile, gold prices have touched 6-year highs above $1,700 this week.

This is deflation, loud and clear. Deflation can be defined as a period when the prices of goods and services fall; conversely, during deflation, the purchasing power of money rises.

Gold is the world’s oldest store of value – as such, it should rise increase in value during deflation when compared to other assets.

So, is now a good time to buy gold?