Gold Breaks Out… But No One Cares

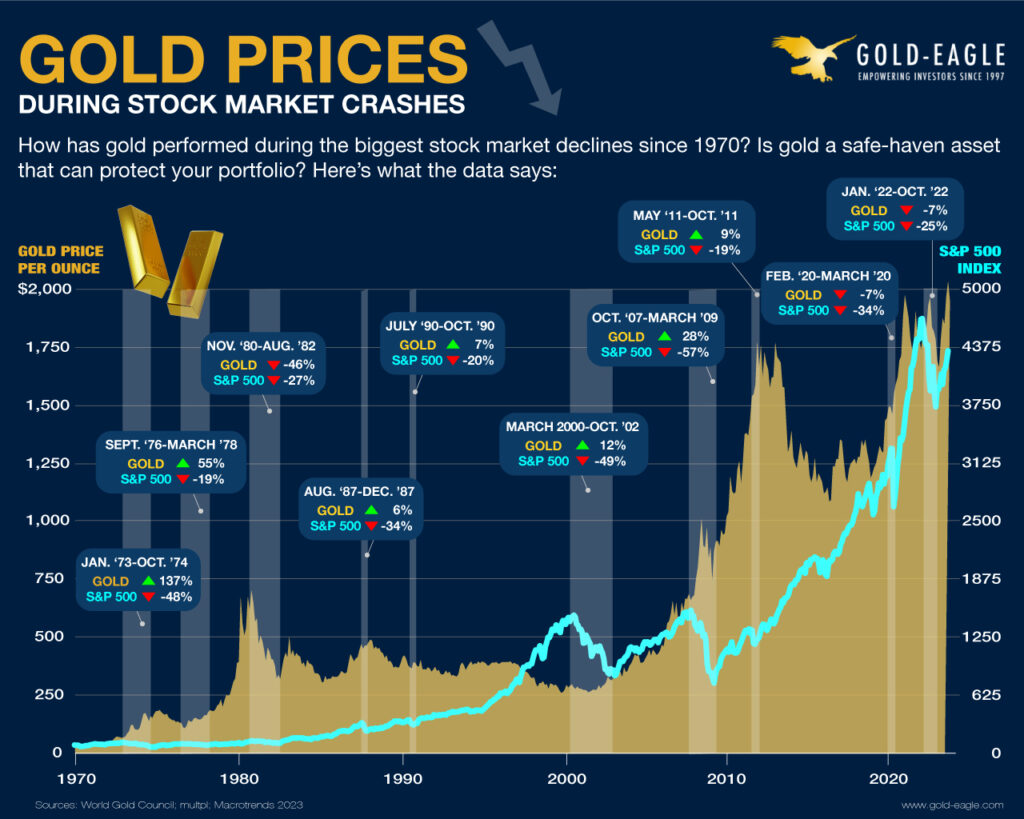

The gold price has just broken out to new all-time record highs. Not a single person who has ever purchased gold in the history of human civilization has ever lost money on their purchase (if they held through today).

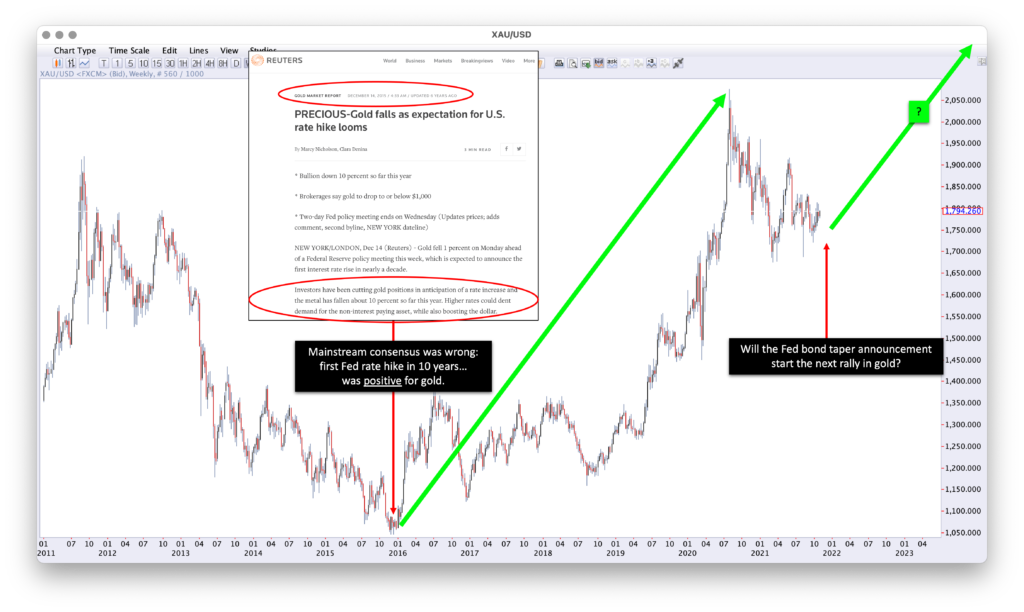

One would think that investors would therefore feel positive about the gold price today.

Yet when we check sentiment indicators – no one seems to care.

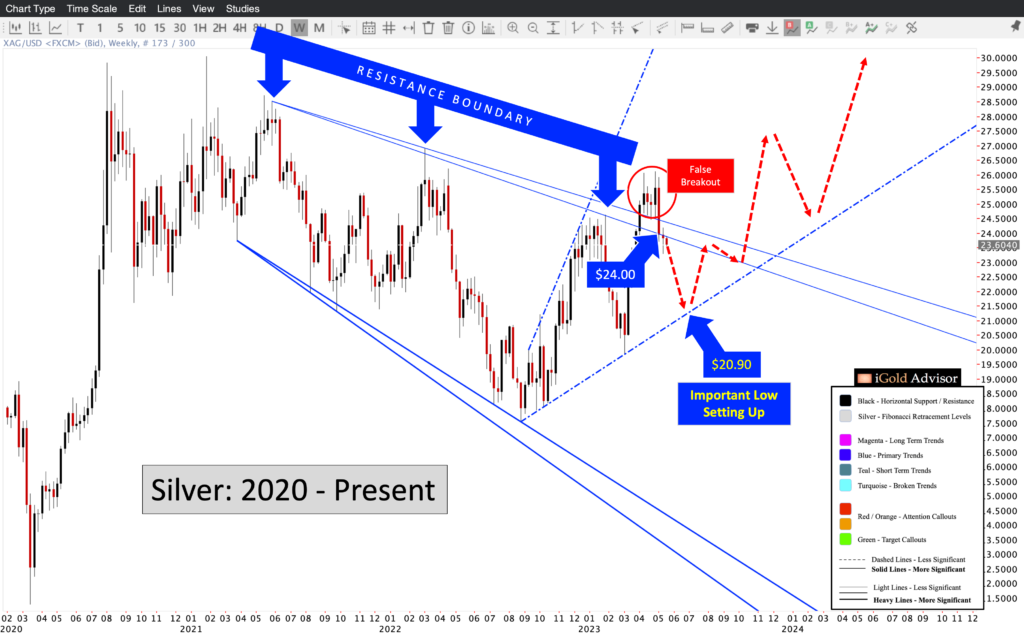

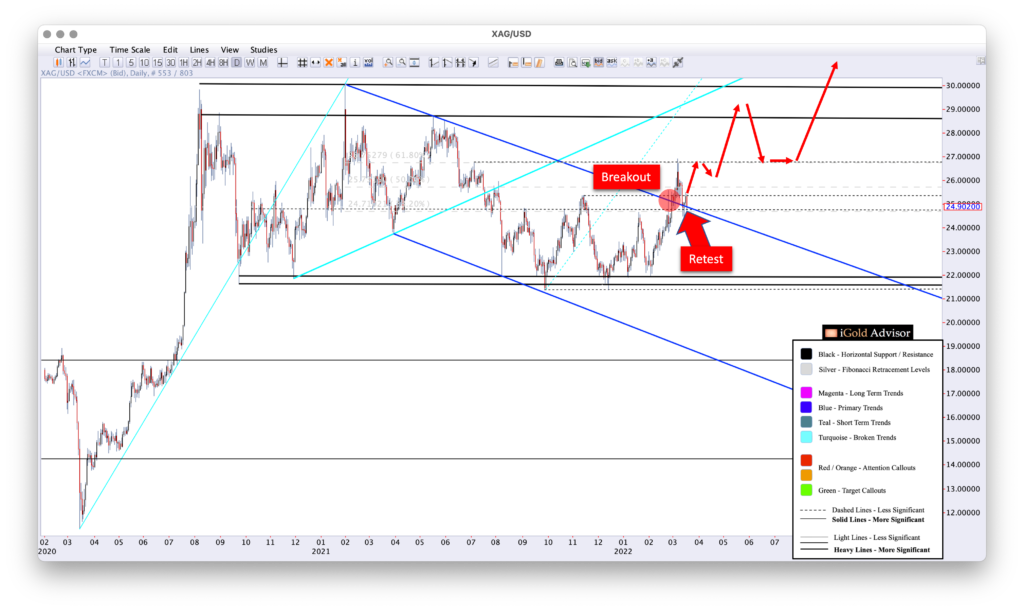

This backdrop of record high prices amidst indifferent sentiment is the most bullish setup that current investors could possibly ask for.

Higher prices lie ahead – this is our conclusion. Hang on to find out why.

Click here to continue reading the full article for FREE on our partner site, Gold Eagle…