On Wednesday, the US Federal Reserve Board unanimously voted to raise interest rates for its overnight lending facility by 0.25%. This puts the target range set by the Central Bank to between 0.25 – 0.50%, with some leeway for rates to fluctuate within this zone.

The move was largely anticipated by the futures market, which began pricing in a near-certain interest rate hike in November. In theory, other world markets should not have reacted with much volatility following the decision, because the rate increase should have been priced in for related assets.

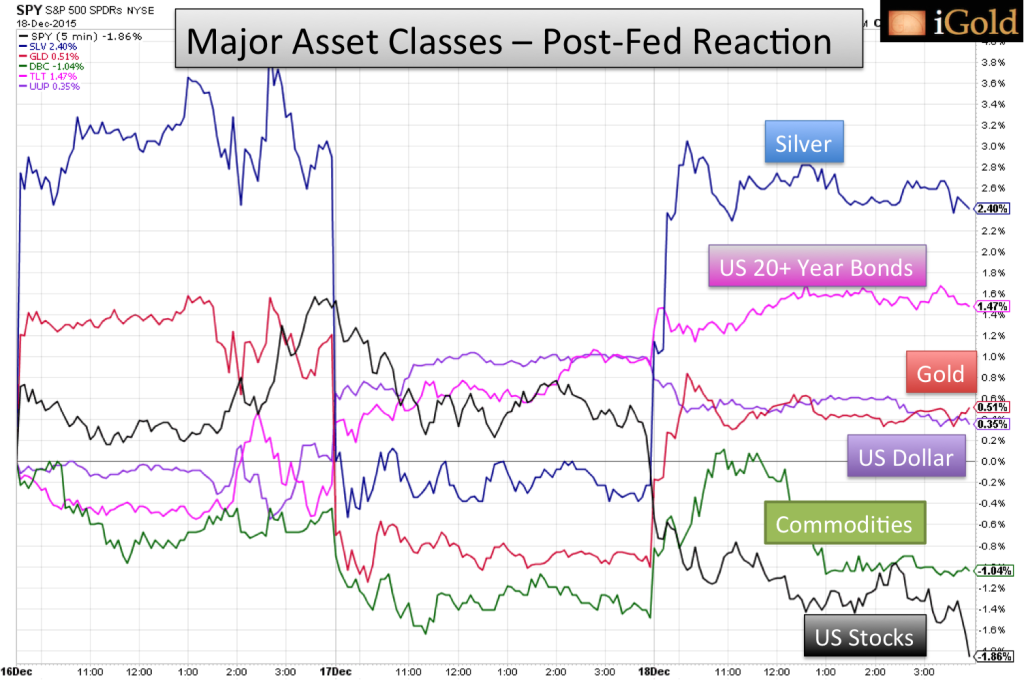

Yet interestingly, an analysis of major asset classes since the decision reveals some distinct price movements. While three days’ worth of trading certainly does not constitute a long-term trend, when viewed within the context of emerging patterns already present in major international markets, this type of analysis can provide valuable clues as to the developing shifts in underlying fundamentals.

Silver, seemingly forgotten after almost five years of declines, emerged as the leader after the rate decision, in major divergence with the rest of the commodity sector and even superior to the traditional safe-havens.